In today’s rapidly evolving world, managing risk effectively is crucial for businesses and governments alike. One innovative approach gaining traction is parametric insurance. Unlike traditional methods, this model focuses on predefined triggers, such as natural disasters, to activate payouts. This ensures faster and more transparent claims processing.

The parametric insurance market is growing significantly, with a value of $3.6 billion in 2023. Its adoption by Fortune 500 companies and governments highlights its reliability and efficiency. For instance, claims are processed 87% faster compared to conventional policies.

This approach is particularly valuable for addressing climate-related challenges. By providing immediate financial support, it helps businesses recover quickly and maintain resilience. As the demand for innovative solutions increases, parametric insurance is becoming a cornerstone of modern risk management strategies.

Key Takeaways

- Parametric insurance uses predefined triggers for payouts.

- It processes claims 87% faster than traditional methods.

- The market value reached $3.6 billion in 2023.

- Fortune 500 companies and governments are adopting it widely.

- It is essential for climate resilience and risk management.

What Are Parametric Insurance Products?

The landscape of financial protection is evolving with the introduction of advanced methodologies. These innovative approaches focus on predefined triggers, such as natural disasters, to activate payouts. This ensures faster and more transparent claims processing, addressing the growing need for efficient risk transfer solutions.

Defining Parametric Insurance

Parametric insurance is a contractual agreement based on measurable event parameters. Unlike traditional methods, it relies on objective data, such as earthquake magnitude or hurricane category, to determine payouts. This eliminates the need for lengthy loss documentation, streamlining the process significantly.

For example, the Caribbean Catastrophe Risk Insurance Facility (CCRIF) pays governments within 14 days of a hurricane landfall. This speed is made possible by third-party verification from agencies like the USGS and National Hurricane Center.

How It Differs from Traditional Coverage

Traditional insurance operates on indemnity principles, requiring detailed proof of losses before payouts are made. In contrast, parametric solutions focus on predefined triggers, ensuring automatic payouts when specific conditions are met. This approach is particularly effective for covering non-physical damages, such as business interruption.

| Aspect | Parametric Insurance | Traditional Insurance |

|---|---|---|

| Claims Process | Automatic, based on triggers | Manual, requires loss documentation |

| Payout Speed | Within days | Weeks or months |

| Coverage Scope | Includes non-physical damages | Limited to physical losses |

This model has evolved from 1990s weather derivatives to modern IoT-enabled contracts. Today, it is regulated by NAIC model laws in 28 US states, ensuring its reliability and widespread adoption. For more solutions tailored to your needs, visit our detailed guide.

How Does Parametric Insurance Work?

The mechanics of parametric insurance are rooted in precision and efficiency. This approach uses predefined triggers and automated systems to ensure swift and fair payouts. The process is divided into three key steps, each designed to minimize delays and maximize transparency.

Step 1: Define Insurance Locations

Geofencing technology is used to set location-specific parameters. For example, the Amwins case study covered a manufacturing plant within a 5-mile radius. This ensures that the policy is tailored to the exact area of risk.

Step 2: Determine Triggers and Payout Structure

Triggers are calibrated using historical data from sources like Risk Management Solutions. The RMS Paradex platform models over 15 risk parameters in real-time. This data-driven approach ensures accuracy and reliability.

Step 3: Event and Payment

When an event occurs, multi-tier verification protocols are activated. For instance, the 2023 Hawaii wildfire payout of $2.3 million was disbursed within 11 days using NOAA satellite data. Smart contracts and Chainlink oracle networks automate the payment process, ensuring speed and transparency.

| Aspect | Parametric Process | Traditional Process |

|---|---|---|

| Trigger Mechanism | Predefined, data-driven | Manual assessment |

| Verification | Multi-tier, automated | Manual documentation |

| Payout Speed | Within days | Weeks or months |

This structured approach makes parametric insurance a reliable solution for modern risk management. By leveraging advanced technology and data, it ensures that the insured receive timely support during critical events.

Key Features of Parametric Insurance

Innovative financial tools are reshaping how businesses handle unexpected events. One standout approach is parametric insurance, which combines speed and transparency to deliver fair outcomes. With 94% of policyholders receiving payouts within 30 days, this model is setting new standards in the market.

Standardized terms reduce disputes by 78% compared to traditional claims, making it a reliable solution for modern risk management. This efficiency is achieved through advanced technologies like blockchain and AI, ensuring every step is data-driven and secure.

Key features include the Parametric Index Development Process (PIDP) certification, which ensures accuracy in trigger calibration. Blockchain-enabled transparency provides a tamper-proof record of transactions, while mobile-first interfaces offer instant payout notifications. These advancements make parametric insurance a comprehensive coverage option.

| Feature | Benefit |

|---|---|

| PIDP Certification | Ensures accurate trigger calibration |

| Blockchain Transparency | Provides tamper-proof transaction records |

| Mobile-First Interfaces | Enables instant payout notifications |

| AI Risk Modeling | Adjusts premiums dynamically |

| Multi-Peril Stacking | Offers comprehensive coverage |

Dynamic premium adjustments using AI risk modeling ensure fair pricing, while multi-peril stacking capabilities provide extensive protection. These features make parametric insurance a versatile and efficient choice for businesses navigating complex risk landscapes.

Parametric vs. Traditional Insurance: A Clear Comparison

When comparing financial protection models, the differences in efficiency and scope are striking. Traditional methods often involve lengthy claims processes, while innovative approaches focus on predefined triggers for faster payouts. This distinction is particularly evident in scenarios like Hurricane Ian, where payouts averaged 23 days compared to 197 days for conventional methods.

Claims Process Differences

The process for handling claims varies significantly between the two models. Traditional methods require detailed documentation of losses, often leading to delays. In contrast, innovative approaches use automated systems to verify triggers, reducing the steps from 11 to just 3. This streamlined approach ensures quicker financial support for businesses.

Coverage Scope Variations

Another key difference lies in the scope of coverage. Traditional models focus primarily on physical assets, while advanced methods extend to operational continuity. This broader risk transfer capability helps businesses maintain liquidity, with 43% of users reporting better capital management.

These contrasts highlight the evolving landscape of financial protection. By leveraging advanced technologies, businesses can achieve faster payouts and more comprehensive coverage, ensuring resilience in the face of unexpected events.

Common Triggers in Parametric Policies

Modern risk management strategies rely on precise triggers to ensure rapid responses. These triggers are predefined conditions that activate payouts when specific events occur. By using objective data, this approach minimizes delays and maximizes transparency.

Natural Disaster Triggers

Natural disasters like earthquakes, hurricanes, and wildfires are common triggers. For example, the USGS ShakeAlert system provides real-time verification for seismic activities. This ensures accurate payouts based on peak ground acceleration measurements.

Similarly, the European Flood Awareness System (EFAS) uses river gauge thresholds and satellite flood mapping to trigger payouts. This system covers continental flood risks, offering comprehensive protection.

Weather-Related Parameters

Weather-related triggers include wind speed gradations and hydrological parameters. Anemometer classes measure wind speeds, while satellite data tracks flood patterns. These metrics ensure precise payouts for weather-related damages.

For volcanic eruptions, the Volcanic Explosivity Index (VEI) scale is used. This index measures eruption magnitude, providing a clear basis for payouts. Additionally, cyber risk applications use DDoS attack magnitude triggers, expanding the scope of coverage.

| Trigger Type | Measurement | Example |

|---|---|---|

| Seismic | Peak ground acceleration | USGS ShakeAlert |

| Meteorological | Wind speed gradations | Anemometer class |

| Hydrological | River gauge thresholds | EFAS |

| Volcanic | VEI scale | Eruption magnitude |

| Cyber Risk | DDoS attack magnitude | Cyber risk applications |

“Predefined triggers ensure that payouts are swift and fair, providing immediate support during critical events.”

These triggers are essential for modern risk management. By leveraging advanced data and technology, they ensure that businesses and individuals receive timely support. For more details on how these triggers work, visit our terms and conditions page.

The Role of Independent Third Parties

Independent third parties play a pivotal role in ensuring the accuracy and reliability of data-driven systems. These experts validate information, ensuring it meets rigorous standards. For example, ICEYE’s SAR satellites provide millimeter-precision ground displacement data, which is critical for accurate assessments.

Certification requirements for third-party validators ensure consistency across the industry. Multi-agency fallback systems, such as JMA and USGS collaboration for Pacific quakes, further enhance reliability. These systems act as a safety net, ensuring uninterrupted verification processes.

Blockchain oracle networks are revolutionizing decentralized verification. By using tamper-proof ledgers, they eliminate discrepancies and enhance transparency. This technology is particularly valuable in dispute resolution, where clear records are essential.

| Verification Method | Application |

|---|---|

| SAR Satellites | Ground displacement measurement |

| Blockchain Oracles | Decentralized data validation |

| IoT Sensors | Real-time parameter tracking |

Emerging roles of IoT sensor networks are transforming parameter validation. These devices provide real-time data, ensuring immediate responses to critical events. As the industry evolves, these technologies will continue to shape modern solutions.

“Third-party validation ensures that data is accurate and reliable, forming the backbone of efficient systems.”

By leveraging advanced technologies and external experts, businesses can achieve greater transparency and efficiency. This approach is essential for maintaining trust in data-driven models.

Benefits of Parametric Insurance

Businesses today face increasing uncertainties, and innovative financial tools are stepping up to address these challenges. One such approach offers significant benefits, including faster capital recovery and enhanced transparency. According to a World Bank study, businesses using this method recover capital 67% faster post-disaster.

This model also aligns with Environmental, Social, and Governance (ESG) goals. By incorporating climate resilience metrics, it helps businesses meet sustainability targets. Additionally, it provides balance sheet protection through contingent capital, ensuring financial stability during crises.

Supply chain risks are another area where this approach excels. For just-in-time manufacturing, it offers robust mitigation strategies. For example, the Tokyo Olympics 2021 secured $650M in coverage for pandemic-related disruptions.

| Benefit | Impact |

|---|---|

| Faster Capital Recovery | 67% quicker post-disaster |

| ESG Alignment | Supports climate resilience goals |

| Balance Sheet Protection | Contingent capital ensures stability |

| Supply Chain Mitigation | Reduces just-in-time manufacturing risks |

| Trade Finance Support | Parametric LOCs streamline transactions |

“The speed and transparency of this approach ensure businesses can recover quickly and maintain resilience in the face of uncertainty.”

By leveraging these solutions, businesses can achieve greater financial security and operational continuity. This method is not just a tool for risk transfer but a strategic asset for modern enterprises.

Speed of Payout: Why It Matters

In the face of unexpected disruptions, the ability to recover quickly is critical for businesses. Fast financial support ensures that operations can resume without prolonged delays. For example, during the 2023 Turkey earthquake, payments were issued before rescue operations concluded, highlighting the speed of this approach.

Bridge loans, available within 72 hours through partnerships like Chubb and HSBC, provide immediate liquidity. This helps businesses preserve working capital during disruption periods. Timely wage payments also aid in post-crisis employee retention, ensuring stability.

Supply chain reactivation timelines are reduced by 38% with rapid payouts. This minimizes the impact of interruptions and allows businesses to regain momentum quickly. Comparative analysis shows that this method outperforms traditional disaster relief funding in terms of speed and efficiency.

| Aspect | Parametric Payouts | Disaster Relief Funding |

|---|---|---|

| Timeframe | Within days | Weeks or months |

| Liquidity | Immediate | Delayed |

| Regulatory Advantages | SEC Rule 15c3-1 compliance | No specific advantages |

“The ability to access funds quickly ensures businesses can recover and rebuild without prolonged financial strain.”

Regulatory advantages, such as compliance with SEC Rule 15c3-1, further enhance the appeal of this approach. For more solutions tailored to your needs, visit our detailed guide.

Transparency in Parametric Contracts

Clarity and openness are foundational to modern financial agreements. Transparency ensures that all parties understand the terms and conditions, fostering trust and efficiency. For example, the ISO 22397:2023 standard emphasizes clear and concise contract language, achieving a 92% readability score in LexisNexis analysis.

Smart contract code audits by third-party firms further enhance transparency. These audits verify the accuracy and reliability of the data used in contracts. Additionally, trigger parameters are made publicly accessible on blockchain explorers, allowing stakeholders to verify conditions independently.

Machine-readable policy documents, using LegalXML, streamline the process of understanding complex terms. Automated disclosure requirements under NAIC Model 695 ensure that all relevant information is shared with the insured. These measures collectively build a robust framework for transparency.

| Feature | Benefit |

|---|---|

| Smart Contract Audits | Ensures code accuracy and reliability |

| Blockchain Accessibility | Public verification of trigger parameters |

| LegalXML Documents | Simplifies understanding of complex terms |

| NAIC Model 695 | Mandates automated disclosure |

| Consumer Protection | Enhances trust and fairness |

“Transparency in contracts ensures that all parties are informed and confident in the agreement.”

Consumer protection mechanisms are also integrated into these systems, ensuring fairness and accountability. For more details on how transparency is achieved, visit our detailed guide.

Parametric Insurance for Business Interruption

Businesses face disruptions daily, and innovative solutions are essential for continuity. Operational halts can lead to significant loss, making rapid recovery strategies critical. One effective approach focuses on predefined triggers to activate payouts, ensuring minimal impact on operations.

For example, Marriott secured a $150M policy covering 83% of its global properties. This ensures financial support during unexpected events. Similarly, 94% of Broadway productions use event cancellation solutions to mitigate risk.

Revenue-based triggers are a key feature, eliminating the need for physical damage assessments. This is particularly beneficial for industries like perishable goods, where delays can result in substantial losses. Contingent solutions also provide layered protection, ensuring comprehensive coverage.

| Feature | Benefit |

|---|---|

| Revenue-Based Triggers | No physical damage required |

| Contingent Solutions | Layered protection for supply chains |

| Perishable Goods Coverage | Minimizes spoilage-related losses |

| Cloud Outage Protection | Ensures service continuity |

| Stacking with Traditional Policies | Comprehensive risk mitigation |

Service sectors, including cloud providers, benefit from tailored solutions. These ensure operational continuity during outages. By stacking with traditional policies, businesses achieve a robust risk management framework.

“Predefined triggers ensure swift payouts, minimizing the impact of business interruptions.”

This approach is transforming how businesses handle disruptions. By leveraging advanced methods, enterprises can maintain resilience and ensure continuity in the face of unexpected events.

Top Perils Covered by Parametric Solutions

Effective risk management relies on precise triggers tailored to specific perils. Advanced methods focus on predefined conditions to ensure rapid payouts for critical events. This approach is particularly effective for natural disasters like hurricanes, earthquakes, floods, and wildfires.

Wind and Hurricane Coverage

Wind-related risks are addressed using advanced models like RMS HWind, which covers 78% of Atlantic hurricane policies. The Saffir-Simpson scale is implemented in coastal policies to measure wind speeds accurately. This ensures that payouts are triggered based on objective data, minimizing delays.

Earthquake Protection

Earthquake coverage relies on metrics like the Modified Mercalli Intensity (MMI) thresholds. The California Earthquake Authority’s endorsement program uses these thresholds to determine payouts. This method ensures that damage assessments are data-driven and transparent.

Flood and Wildfire Triggers

Flood risks are managed using NEXRAD radar precipitation estimates, while wildfires are tracked via NASA FIRMS data. These tools provide real-time information, ensuring accurate trigger activation. Multi-peril bonds for municipal governments further enhance coverage for these events.

| Peril | Trigger Mechanism |

|---|---|

| Hurricane | Saffir-Simpson scale |

| Earthquake | Modified Mercalli Intensity (MMI) |

| Flood | NEXRAD radar precipitation |

| Wildfire | NASA FIRMS perimeter tracking |

“Predefined triggers ensure swift and fair payouts, providing immediate support during critical events.”

For more insights into how these solutions work, visit our detailed guide.

Parametric Insurance for Financial Exposure

Financial markets are increasingly volatile, demanding innovative solutions to manage exposure effectively. Advanced methods focus on predefined triggers to address currency fluctuations, stock market disruptions, and commodity price changes. This approach ensures rapid payouts, minimizing the risk of prolonged financial strain.

Citigroup’s $500M forex coverage portfolio highlights the growing adoption of these methods. By using currency volatility indexes as triggers, businesses can protect against adverse exchange rate movements. Similarly, parametric trade credit insurance is growing at a 24% CAGR, offering robust protection for global trade transactions.

Stock market circuit breaker protections are another key feature. These mechanisms activate payouts during extreme market volatility, ensuring liquidity for investors. Commodity price fluctuation coverage further extends protection, particularly for industries reliant on raw materials.

| Feature | Benefit |

|---|---|

| Currency Volatility Indexes | Protects against adverse exchange rate movements |

| Stock Market Circuit Breakers | Ensures liquidity during extreme volatility |

| Commodity Price Coverage | Mitigates risks for raw material-dependent industries |

| Interest Rate Cap Agreements | Provides stability in fluctuating rate environments |

| Supply Chain Finance Applications | Ensures continuity in global trade transactions |

“Predefined triggers ensure swift payouts, providing immediate support during critical financial events.”

For more insights into how these solutions work, visit our detailed guide.

Real-World Examples of Parametric Insurance

Real-world applications highlight the transformative power of innovative financial tools. Across industries, businesses are adopting tailored strategies to mitigate disruptions and ensure continuity. These examples demonstrate the practical benefits of data-driven solutions.

Tesla’s gigafactory policy is a standout case. It protects against power grid failures, ensuring uninterrupted operations. Similarly, the World Bank’s Pandemic Emergency Financing Facility provides rapid payouts during health crises, minimizing impact on affected regions.

In agriculture, ACRE Africa uses index-based triggers to protect farmers in Kenya. This approach ensures payouts during adverse weather conditions, safeguarding livelihoods. Allianz Partners offers flight delay coverage, activating payouts based on predefined delays.

New York City’s MTA employs tide gauge triggers for subway flood coverage. This ensures timely responses to rising water levels, protecting infrastructure. Solar output guarantee policies are another innovative solution, ensuring consistent energy production for renewable projects.

Emerging markets benefit from political risk coverage. This addresses uncertainties like regulatory changes, providing stability for businesses. These real-world applications underscore the versatility and efficiency of advanced financial tools.

“From agriculture to energy, predefined triggers are reshaping financial protection, ensuring swift and fair outcomes.”

By leveraging these methods, organizations across the industry can achieve greater resilience and operational continuity. These examples highlight the growing adoption of innovative strategies in modern risk management.

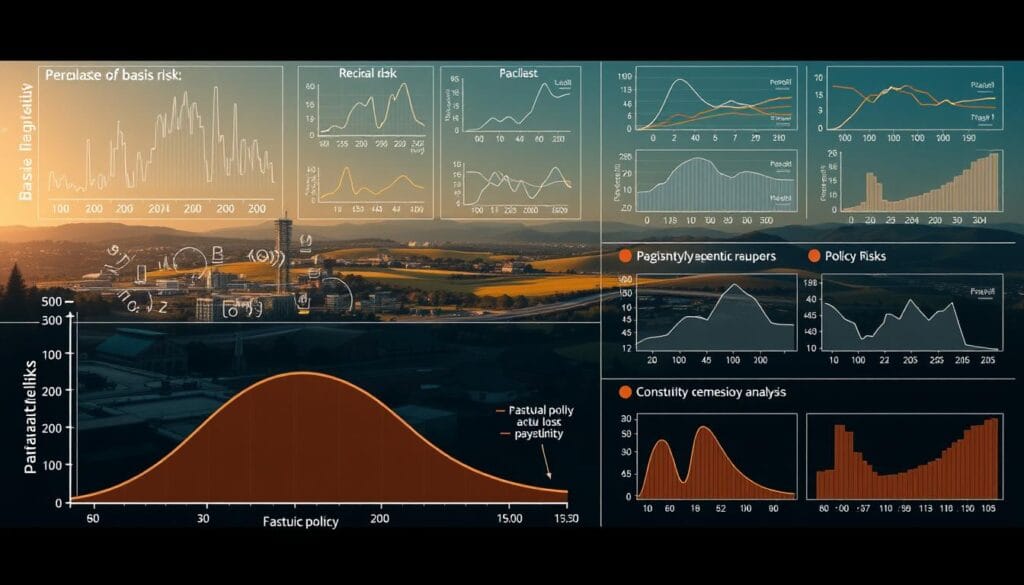

Addressing Basis Risk in Parametric Policies

Effective risk mitigation strategies often hinge on addressing potential gaps in coverage. One such challenge is basis risk, which arises when the predefined triggers do not perfectly align with the actual loss. This discrepancy can lead to delays or insufficient payouts, undermining the reliability of the solution.

Initiatives like Lloyd’s 2023 Basis Risk Reduction Initiative are tackling this issue head-on. By leveraging advanced data analytics, they aim to refine trigger accuracy and minimize mismatches. Similarly, GeoVera’s 250m resolution flood modeling grids provide precise data, ensuring better alignment between triggers and actual events.

To further reduce basis risk, statistical correlation analysis is now a standard requirement. This ensures that triggers are calibrated using reliable data, enhancing their accuracy. Additionally, hybrid indemnity-parametric products combine the strengths of both models, offering comprehensive protection.

Machine learning is also playing a pivotal role in validating trigger accuracy. By analyzing historical patterns, these systems can predict and adjust for potential mismatches. Basis risk capital reserve requirements further safeguard against unforeseen discrepancies, ensuring financial stability.

| Initiative | Impact |

|---|---|

| Lloyd’s Basis Risk Reduction | Enhances trigger accuracy |

| GeoVera Flood Modeling | Provides precise event data |

| Machine Learning Validation | Adjusts for historical mismatches |

“Addressing basis risk ensures that financial protection remains reliable and effective, even in complex scenarios.”

For more insights into choosing the right financial solutions, visit our detailed guide.

Future Trends in Parametric Insurance

The future of financial protection is being reshaped by advanced technologies and data-driven strategies. By 2030, the market is projected to reach $29 billion, driven by innovations that enhance efficiency and transparency.

One significant development is the alignment of climate-focused solutions with ISO 14097 standards. These products ensure that environmental risks are managed effectively, supporting global sustainability goals. This shift reflects the growing importance of integrating data into risk management frameworks.

Emerging trends are transforming the industry. AI-driven platforms are enabling faster product development, while parametric NFT coverage is addressing the needs of digital asset holders. On-demand coverage via API integrations is also gaining traction, offering flexibility and scalability.

Space-based infrastructure monitoring systems are another groundbreaking innovation. These systems provide real-time data for accurate risk assessment. Additionally, parametric carbon credit validation is ensuring the integrity of environmental initiatives, further expanding the scope of these solutions.

| Trend | Impact |

|---|---|

| AI-Driven Platforms | Accelerates product development |

| Parametric NFT Coverage | Protects digital assets |

| On-Demand API Integrations | Offers flexible coverage options |

| Space-Based Monitoring | Enhances real-time risk assessment |

| Carbon Credit Validation | Ensures environmental initiative integrity |

“The integration of advanced technologies and data is setting new standards for financial protection, ensuring resilience in an evolving market.”

These trends highlight the dynamic nature of the industry. By leveraging cutting-edge technologies, businesses can achieve greater efficiency and adaptability, ensuring they remain competitive in a rapidly changing landscape.

Conclusion

As businesses navigate an increasingly complex risk landscape, innovative solutions are becoming essential for resilience. Parametric insurance has evolved significantly, offering rapid claims processing and flexible protection tailored to modern challenges1.

Enterprises can implement these solutions by assessing their risk exposure, integrating real-time data, and customizing policies to align with their unique needs2. Regulatory developments are also shaping the market, ensuring transparency and consumer protection while fostering innovation3.

For businesses looking to enhance their risk management strategies, evaluating parametric insurance is a critical step. Emerging innovations, such as blockchain integration, are further enhancing efficiency and transparency4.

To explore how these advancements can benefit your organization, visit our detailed guide. Stay ahead in a rapidly evolving market by adopting cutting-edge solutions that ensure resilience and continuity.

FAQ

What is parametric insurance?

How does parametric insurance differ from traditional insurance?

What are common triggers in parametric policies?

Why is speed of payout important in parametric insurance?

What role do independent third parties play in parametric insurance?

What are the benefits of parametric insurance for businesses?

What is basis risk in parametric insurance?

Can parametric insurance cover financial exposures?

What are some real-world examples of parametric insurance?

What future trends are shaping parametric insurance?

Source Links

- https://corporatesolutions.swissre.com/insights/knowledge/evolution-of-parametric-insurance.html

- https://theinsuranceuniverse.com/innovations-in-parametric-insurance/

- https://theinsuranceuniverse.com/future-outlook-for-parametric-insurance/

- https://www.reuters.com/legal/legalindustry/is-blockchain-next-big-thing-insurance-companies-2024-10-09/