Did you know that Bitcoin’s network processes over 640 exahashes per second? This staggering figure highlights the immense computational power behind decentralized systems. At its core, blockchain is a decentralized digital ledger that securely stores immutable records across a network of computers. Unlike traditional databases, it relies on distributed consensus mechanisms, ensuring transparency and trust without a central authority.

One of its defining features is cryptographic security, which protects data from tampering. Each transaction is linked chronologically, creating a chain of records that is nearly impossible to alter. Beyond cryptocurrency, this system is transforming industries like supply chain management and healthcare. For example, IBM’s Food Trust tracks over 25 food items from farm to retail, ensuring transparency and safety.

With 85% of Fortune 500 companies adopting blockchain solutions, its impact is undeniable. Whether it’s enhancing voting systems or streamlining logistics, this innovation is reshaping how we handle data and transactions. To learn more about how advanced systems are driving efficiency, check out our review on robo-advisor performance.

Key Takeaways

- Blockchain is a decentralized ledger that ensures secure, immutable records.

- It uses distributed consensus mechanisms for transparency and trust.

- Key features include cryptographic security and chronological data chaining.

- Applications extend beyond cryptocurrency to supply chain, healthcare, and voting.

- IBM’s Food Trust uses blockchain to track food items from farm to retail.

- Bitcoin’s network processes over 640 exahashes per second.

- 85% of Fortune 500 companies are adopting blockchain solutions.

What Is Blockchain Technology?

What makes a decentralized ledger so different from traditional databases? At its core, a decentralized ledger is a system where data is stored across a vast network of computers, known as nodes. Unlike traditional databases, which rely on a central authority, this approach ensures transparency and security through peer-to-peer architecture.

The Basics of a Decentralized Ledger

In a decentralized ledger, information is distributed across thousands of nodes. For example, Bitcoin’s network consists of over 10,000 nodes, each maintaining a copy of the ledger. This distribution ensures that no single entity controls the data, making it highly resistant to tampering.

Ethereum, another prominent network, has over 1 million validators staking 33.8 million ETH as of September 2024. This massive participation highlights the scalability and trust inherent in decentralized systems.

Blockchain vs. Traditional Databases

Traditional databases, like SQL, rely on a centralized structure. A single server or entity manages the data, which can create vulnerabilities. In contrast, decentralized ledgers use a peer-to-peer network, where every participant has equal access and control.

For instance, HSBC’s FX Everywhere processes over $250 billion in transactions using a private blockchain. This system reduces processing times and enhances security compared to traditional methods.

Walmart’s use of decentralized systems for food traceability is another example. It takes just 2.2 seconds to trace an item’s origin, compared to the traditional 7-day process. This efficiency demonstrates the practical advantages of decentralized ledgers.

However, energy consumption remains a concern. Bitcoin’s network consumes 147TWh annually, while Visa’s system uses only 0.19TWh. This stark difference highlights the need for sustainable solutions in decentralized systems.

To explore how advanced systems are transforming other industries, check out our guide on robo-advisors for retirement planning.

Blockchain Technology Explained: How It Works

At the heart of decentralized systems lies a unique structure of blocks and chains. These components work together to ensure secure and transparent record-keeping. Each block contains a set of transactions, and they are linked together in a chronological sequence, forming a chain. This design makes tampering nearly impossible.

The Role of Blocks and Chains

Each block includes a timestamp, a nonce, a Merkle root, and the hash of the previous block. The SHA-256 hash function, for example, produces a 64-character hexadecimal string. This ensures the integrity of the data. Once a block is added to the chain, altering it would require changing all subsequent blocks, which is computationally infeasible.

Cryptography and Hashing

Cryptography plays a vital role in securing the system. Hash functions create unique identifiers for each block, ensuring immutability. For instance, Bitcoin uses SHA-256, while Ethereum employs Keccak-256. These functions make it nearly impossible to reverse-engineer the data, providing a high level of security.

Consensus Mechanisms: Proof of Work vs. Proof of Stake

Consensus mechanisms ensure agreement across the network. Proof of Work (PoW) requires solving complex mathematical problems, consuming significant energy. Bitcoin’s network processes 145 quintillion hashes per second. In contrast, Proof of Stake (PoS) randomly selects validators, reducing energy consumption. Ethereum’s transition to PoS has cut energy use by 99.95%.

Transaction finality also differs. Bitcoin requires six confirmations, taking about an hour, while Ethereum’s 12-second block time ensures faster processing. These mechanisms highlight the trade-offs between security, speed, and sustainability.

Key Components of a Blockchain Network

Nodes and smart contracts are the building blocks of a decentralized ecosystem. These elements ensure the network operates efficiently and securely. Understanding their roles is crucial for grasping the full potential of this innovative system.

Nodes and Decentralization

Nodes are the backbone of any decentralized system. They come in various types, including full, light, mining, and archival nodes. Each plays a unique role in maintaining the network’s integrity and functionality.

Public and private networks have different participation rules. For example, public nodes allow anyone to join, while private networks restrict access to authorized participants. This distinction impacts the level of transparency and control within the system.

The Home Depot uses IBM’s network to resolve vendor disputes efficiently. This application highlights how nodes can streamline complex processes in real-world scenarios.

Smart Contracts Defined

Smart contracts are self-executing agreements coded into the system. They automate processes, reducing the need for intermediaries. For instance, DeFi protocols process over $100 billion through these automated contracts.

Financial institutions are increasingly adopting this technology. As of 2024, 82% of them are implementing smart contracts to enhance efficiency and reduce costs. This trend underscores their growing importance in modern finance.

DAO governance models also rely on smart contracts to prevent 51% attacks. These mechanisms ensure fairness and security in decentralized decision-making processes.

To explore how advanced systems are transforming other industries, check out our guide on AI in credit risk assessment.

The Transaction Process on a Blockchain

Every transaction on a decentralized network follows a precise lifecycle, ensuring security and efficiency. From creation to confirmation, each step is designed to maintain integrity and transparency. This process is fundamental to the system’s reliability and trustworthiness.

From Initiation to Confirmation

A transaction begins when a user initiates a transfer of assets. This action is then propagated across the network, where it awaits validation. Validators or miners verify the transaction’s authenticity before including it in a block. Once added, the transaction is considered confirmed.

For example, Bitcoin’s mempool can store over 50,000 unconfirmed transactions in its 300MB capacity. This highlights the network’s ability to handle large volumes efficiently. Ethereum’s EIP-1559 mechanism introduces a base fee for gas, ensuring fair pricing and reducing congestion.

Mining and Validators

Mining plays a crucial role in securing the network. Miners solve complex mathematical problems to add new blocks, earning rewards in return. ASIC miners, for instance, remain profitable at $0.05/kWh electricity rates.

Mining pools control 65% of Bitcoin’s hash rate, ensuring collective efficiency. Meanwhile, Binance’s Layer-2 solution processes 1.4 million transactions per second, showcasing scalability advancements. In contrast, Ethereum faces scalability limits, processing far fewer transactions than Visa’s 24,000 TPS.

Validators in Proof of Stake systems replace miners, reducing energy consumption. They are randomly selected to confirm transactions, ensuring fairness and security. This shift highlights the ongoing evolution of decentralized systems.

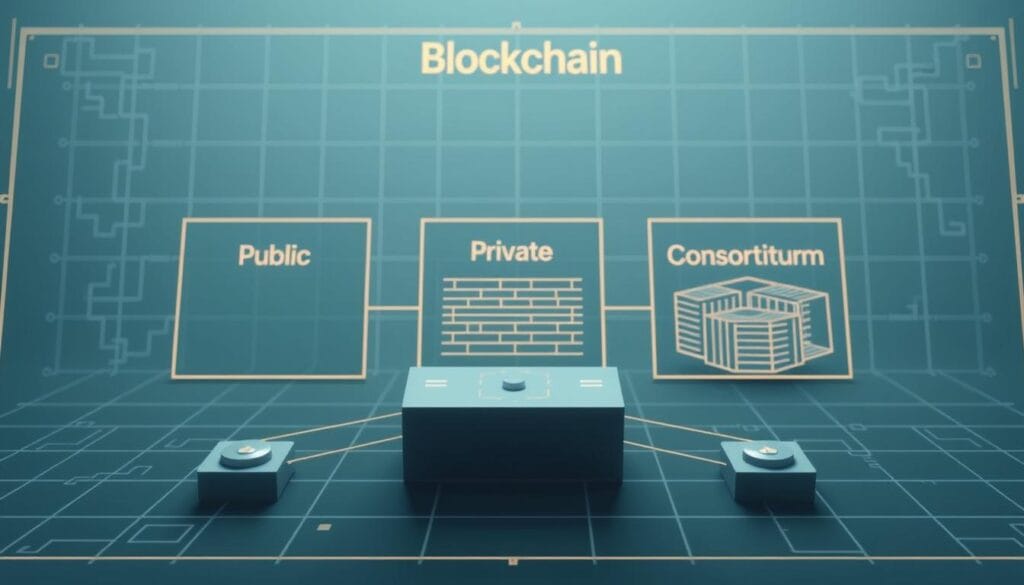

Types of Blockchains: Public, Private, and Consortium

Decentralized systems come in various forms, each tailored to specific needs. These types include public, private, and consortium models, each with distinct characteristics and applications. Understanding these variations is essential for businesses and organizations looking to leverage their unique benefits.

Public Blockchains

Public blockchains, like Bitcoin, operate on a permissionless model. Anyone can join the network, validate transactions, and participate in consensus. This openness ensures transparency but requires significant computational resources. For example, Bitcoin’s network processes over 640 exahashes per second, showcasing its robust security.

In contrast, JP Morgan’s Onyx uses a permissioned model, restricting access to authorized participants. This approach enhances privacy and control, making it ideal for enterprise applications.

Private Blockchains for Enterprises

Private blockchains are designed for business use, offering enhanced security and efficiency. Hyperledger’s modular architecture, for instance, powers over 400 enterprise networks, enabling scalable solutions for industries like finance and supply chain.

Walmart’s adoption of private systems reduced supply chain costs from 25% to 2%. Similarly, Dubai’s government handles 100% of visa applications using a private ledger, streamlining processes and improving transparency.

SWIFT’s experiments with Central Bank Digital Currencies (CBDCs) further highlight the potential of private systems. These networks ensure secure and efficient cross-border payments, reducing reliance on traditional banking systems.

The Energy Web Foundation’s consortium, with over 100 members, demonstrates how collaborative models can drive innovation in energy management. This approach balances transparency with controlled access, ensuring data integrity and security.

Why Blockchain Is Secure and Transparent

Security and transparency are the cornerstones of modern decentralized networks. These systems are designed to ensure that data remains immutable and tamper-proof, while also providing clear visibility into transactions. This combination of features makes them highly reliable for various applications.

Immutability and Tamper-Proof Records

One of the key features of decentralized systems is their ability to create immutable records. Each transaction is cryptographically linked to the previous one, forming a chain that is nearly impossible to alter. For example, Bitcoin’s network has over 800,000 blocks in its history, each secured by the SHA-256 hash function.

This cryptographic chaining ensures that any attempt to tamper with the data would require altering all subsequent blocks, which is computationally infeasible. The cost of a 51% attack on Ethereum, for instance, exceeds $700,000 per hour, making such attacks highly impractical.

Real-World Transparency Examples

Decentralized systems are also transforming industries by enhancing transparency. De Beers’ Tracr platform, for example, has reduced the risk of conflict diamonds by 89% by tracking their provenance. Similarly, Maersk’s TradeLens has cut documentation errors by 45%, streamlining global trade processes.

Zcash’s use of zk-SNARKs demonstrates how selective transparency can be achieved. This technology allows users to verify transactions without revealing sensitive details, balancing privacy with accountability. Additionally, the SEC’s 2024 auditing requirements highlight the growing importance of transparent systems in regulatory compliance.

These examples underscore the practical benefits of decentralized networks in ensuring both security and transparency across various sectors.

Blockchain vs. Traditional Banking Systems

How does a decentralized network compare to traditional banking systems? The differences are stark, especially in efficiency and cost. For instance, RippleNet processes over $15 billion in cross-border transactions, while SWIFT often takes 3-5 days for the same process. This speed advantage is transforming global finance.

Central banks are also exploring decentralized solutions. The BIS 2024 report reveals that 78 central banks are actively researching Central Bank Digital Currencies (CBDCs). This shift highlights the growing trust in decentralized systems for managing currency and financial stability.

Traditional systems like Fedwire handle $3 trillion in daily settlements. In contrast, stablecoin volumes are growing rapidly, offering faster and cheaper alternatives. Similarly, DeFi platforms offer interest rates as low as 0.0001%, compared to the Fed’s 4.25% funds rate. This cost efficiency is driving adoption.

HSBC’s blockchain-based custody services manage $60 billion in assets, showcasing the reliability of decentralized services. Additionally, KYC processes that once took 3 days manually are now instant with digital identity verification. This efficiency reduces friction in financial operations.

BIS Project Mariana’s FX settlement prototype further demonstrates the potential of decentralized systems. By streamlining cross-border payments, it offers a glimpse into the future of global finance. These innovations are reshaping how we think about banking and financial services.

Applications of Blockchain Beyond Cryptocurrency

From tracking ethical sourcing to securing medical records, decentralized systems are reshaping industries. These applications demonstrate the versatility of this innovative approach, solving real-world problems with transparency and efficiency.

Supply Chain Management

In the supply chain sector, decentralized networks ensure ethical sourcing and traceability. Ford, for example, uses this system to track cobalt, ensuring 100% ethical sourcing for its electric vehicles. Similarly, MediLedger has achieved 80% compliance in pharmaceutical serialization, reducing counterfeit drugs and enhancing safety.

Healthcare Data Security

Decentralized systems are revolutionizing healthcare by giving patients control over their records. The Mayo Clinic has implemented a patient-controlled health record system, ensuring data privacy and accessibility. This approach not only improves patient care but also reduces administrative burdens.

Voting Systems and Governance

In governance, decentralized networks enhance transparency and trust. Sierra Leone conducted its 2018 election using this system, ensuring tamper-proof results. Moscow has also leveraged it for over 3,000 property transfers, streamlining processes and reducing fraud.

Wyoming’s 2024 corporate registry modernization and the UN’s food distribution for 1 million refugees further highlight the diverse applications of decentralized systems. These examples underscore their potential to transform industries and improve lives.

Smart Contracts: Automating Trust

Smart contracts are revolutionizing how agreements are executed in the digital age. These self-executing programs automate processes, ensuring efficiency and reducing the need for intermediaries. For example, AXA’s Fizzy parametric insurance pays claims in just 3 minutes, showcasing the speed and reliability of this technology.

Ethereum’s MakerDAO demonstrates the power of smart contracts, with over $7 billion locked in its decentralized finance (DeFi) protocols. Built using Solidity, a Turing-complete programming language, these contracts can handle complex logic and operations. This flexibility makes them ideal for diverse applications, from finance to legal agreements.

DAO governance models, with over $1 billion in total value locked (TVL), rely on smart contracts to ensure transparency and fairness. Similarly, DTCC processes $10 trillion in credit derivatives annually using this technology, highlighting its scalability and security.

OpenLaw’s legal contract automation reduces drafting time by 70%, streamlining workflows for businesses. Chainlink’s 1,000+ oracle networks further enhance these systems by providing real-world data, ensuring accuracy and reliability. These advancements underscore the transformative potential of automation in building trust across industries.

To explore how advanced systems are transforming other sectors, check out our guide on choosing the right robo-advisor.

Blockchain in Finance: Cryptocurrencies and More

The financial sector is undergoing a transformation with the rise of decentralized systems. These innovations are not only changing how we handle money but also redefining global transactions. From cryptocurrencies to cross-border payments, the impact is profound and far-reaching.

Bitcoin and Ethereum Networks

Bitcoin and Ethereum are two of the most prominent networks in this space. Bitcoin processes around 7 transactions per second (TPS), while Visa handles 24,000 TPS. Despite this difference, Bitcoin’s Lightning Network has a $200 million capacity, enabling transactions as low as $0.01, making it ideal for micro-payments.

Ethereum, on the other hand, supports a wide range of applications beyond currency. Its network is transitioning to a more energy-efficient model, reducing its environmental footprint. USDC, a stablecoin, circulates $45 billion across 15+ blockchains, showcasing the scalability of these systems.

Cross-Border Payments

Cross-border payments are another area where decentralized systems excel. Stellar, for instance, settles transactions in just 5 seconds for over 180 currencies. This speed is a game-changer for businesses and individuals alike.

Ripple’s network has reduced remittance costs by 40%, making it a cost-effective solution for global transactions. Additionally, the BIS’s mBridge project handles $22 billion in Central Bank Digital Currency (CBDC) transfers, highlighting the growing adoption of these technologies.

The European Central Bank (ECB) is also preparing for a digital euro, with a 3-year preparation phase underway. This move underscores the potential of decentralized systems to complement traditional financial infrastructures.

Challenges and Limitations of Blockchain

Despite its transformative potential, decentralized systems face significant hurdles. These challenges range from scalability constraints to environmental concerns, which must be addressed for broader adoption.

Scalability Issues

One of the primary limitations is scalability. Bitcoin’s 1.4MB block size restricts its transaction throughput, while Ethereum’s dynamic scaling offers more flexibility. Sharding, a technique in Ethereum 2.0, splits the network into smaller chains, increasing its capacity to 100,000 transactions per second (TPS)1.

Layer-2 solutions like Polygon further enhance scalability, achieving 7,000 TPS through proof-of-stake mechanisms. These advancements are crucial for handling the growing demand for decentralized applications.

Energy Consumption Concerns

Another critical issue is energy consumption. Bitcoin’s Proof of Work (PoW) mechanism consumes 146 terawatt hours annually, surpassing Sweden’s energy usage2. In contrast, Proof of Stake (PoS) reduces energy consumption significantly, with Ethereum’s transition cutting usage by 99.95%.

Bitcoin’s stranded energy utilization in Texas demonstrates innovative approaches to sustainability. However, the high costs of renewable energy mining remain a barrier for many. Google Cloud’s commitment to 100% renewable energy for its nodes highlights the industry’s shift toward greener solutions.

Blockchain for Business: Industry Use Cases

Businesses across industries are leveraging decentralized systems to enhance efficiency and transparency. These use cases demonstrate how innovative solutions are transforming operations, from supply chain management to cloud computing.

Walmart’s Food Trust

Walmart has implemented a decentralized system to trace over 25 food products across 50 markets. This approach ensures ethical sourcing and transparency, reducing the time needed to track products like mangoes from 7 days to just 2.2 seconds.

Maersk’s adoption of this system has cut supply chain costs by 20%, while TradeLens has reduced documentation errors by 50%. These improvements highlight the practical benefits of decentralized systems in logistics and supply chain management.

IBM’s Hybrid Cloud Solutions

IBM serves over 500 enterprise clients with its hybrid cloud solutions, integrating decentralized systems for enhanced security and scalability. DHL uses this technology for pharmaceutical temperature monitoring, ensuring product integrity during transit.

Honeywell’s aerospace parts authentication system further demonstrates the versatility of these solutions. By verifying the authenticity of components, it enhances safety and reduces counterfeiting risks. These examples underscore the transformative potential of decentralized systems in diverse industries.

Future of Blockchain Technology

The landscape of decentralized systems is rapidly evolving, driven by groundbreaking advancements and innovative applications. According to Gartner, 30% of enterprises will adopt this technology by 2026, signaling a significant shift in how businesses operate. The global market is projected to reach $1.4 trillion by 2030, highlighting its immense potential.

One of the most promising developments is the implementation of quantum-resistant cryptography. This approach ensures that decentralized systems remain secure even as quantum computing advances. Additionally, zk-Rollups are expected to enable networks capable of processing 100,000 transactions per second (TPS), addressing current scalability challenges.

The fusion of AI and decentralized systems is another area of future growth. Predictive smart contracts, powered by AI, could automate complex agreements with unprecedented accuracy. This integration is set to revolutionize industries by enhancing efficiency and reducing human error.

Central Bank Digital Currencies (CBDCs) are also gaining traction, with over 20 G20 nations actively exploring their rollout. These digital currencies promise to streamline financial systems and improve cross-border transactions. Furthermore, space-based nodes are being developed to ensure global redundancy, enhancing the resilience of decentralized networks.

To explore how advanced systems are transforming other sectors, check out our guide on low-fee robo-advisors.

Pros and Cons of Adopting Blockchain

Adopting decentralized systems offers both opportunities and challenges for businesses and governments alike. Understanding the pros and cons is essential for making informed decisions about their adoption.

One of the most significant advantages is cost efficiency. For example, trade finance processes see a 67% cost reduction when using decentralized systems. Additionally, crypto transactions can cost as low as $0.01, compared to traditional wire fees of $25. This value proposition is driving widespread interest.

Operational efficiency is another key benefit. Businesses report up to 40% gains in efficiency, streamlining processes like supply chain management and cross-border payments. Dubai’s government, for instance, has achieved 50% cost savings by implementing decentralized solutions.

However, challenges remain. Regulatory uncertainty across 50 jurisdictions complicates adoption. GDPR compliance is particularly tricky, as the immutability of data conflicts with the right to erasure. This issue highlights the need for innovative solutions to balance transparency and privacy.

Security is another concern. While decentralized systems are inherently secure, $12 billion in annual crypto theft underscores the risks. Despite these challenges, the value of decentralized systems in enhancing transparency and efficiency continues to drive their adoption across industries.

For a deeper dive into the pros and cons of decentralized systems, explore this comprehensive analysis.

Conclusion

As decentralized systems continue to evolve, their impact on industries becomes increasingly profound. These systems have redefined security, efficiency, and transparency, offering solutions that traditional models cannot match. Institutions like BlackRock and Fidelity are leading the charge, integrating these innovations into their operations.

However, the future of these systems hinges on interoperability standards. Seamless integration across platforms is essential for widespread adoption. Environmental concerns are also being addressed, with Proof of Stake (PoS) transitions reducing energy consumption significantly.

To sustain this growth, professional education is critical. Demand for skilled developers has surged by 300%, highlighting the need for training programs. As industries embrace these advancements, the potential for transformative change remains immense.