By 2025, over 50% of the U.S. workforce is expected to engage in freelance or gig work. This shift brings unique challenges, especially when it comes to managing taxes and income. While the IRS Free File program offers a free option, it has significant limitations, such as an adjusted gross income cap of $79,000 and no state support.

Freelancers often juggle multiple income streams and complex deductions, making specialized tax software essential. These tools not only simplify filing but also ensure compliance with federal and state regulations. Unlike free options, premium solutions provide step-by-step guidance, audit support, and optimization for deductions.

As the freelance economy grows, choosing the right tool becomes critical for managing your business finances effectively. Let’s explore the top-rated options that balance cost, accuracy, and user experience.

Key Takeaways

- Freelancers face increasing tax complexities in 2025.

- IRS Free File has limitations, including income caps and lack of state support.

- Specialized tools simplify filing and ensure compliance.

- Premium software offers audit support and deduction optimization.

- Choosing the right solution is crucial for managing multiple income streams.

Why Freelancers Need Specialized Tax Software

Navigating tax complexities is a growing concern for independent workers. Unlike traditional employees, freelancers must manage multiple income streams and intricate tax forms. This often includes quarterly payments and the self-employment tax, which adds another layer of difficulty.

Manual calculations can lead to errors, especially when claiming deductions like home office expenses or mileage. A single mistake can result in significant tax liability. According to CNBC Select, 47% of small businesses face IRS penalties averaging $1,500 annually.

Specialized tools help freelancers optimize their business income and deductions. For example, one freelancer saved $2,300 by accurately filing Schedule C deductions. These tools also simplify quarterly payments and ensure compliance with IRS Form 1040-SE requirements.

Remote workers and digital nomads face additional challenges, such as multi-state filing. Discrepancies in forms like the 1099-NEC can trigger audits. Using the right tools minimizes these risks and ensures accurate returns.

For more insights on managing freelance finances, check out this comprehensive guide.

Key Features to Look for in Tax Software for Freelancers

Independent contractors require advanced solutions to handle their unique financial obligations. The right tools can simplify complex processes, ensuring accuracy and compliance. Below are the essential features to consider when selecting a platform.

Self-Employment Tax Support

Freelancers often face challenges with SECA taxes and QBI deductions. Specialized platforms automate these calculations, reducing errors and saving time. For example, TurboTax automatically imports 1099-K data, streamlining the process.

Integration with accounting tools like QuickBooks Self-Employed further enhances efficiency. This ensures seamless tracking of income and expenses, making it easier to manage quarterly payments.

Deduction Maximization Tools

Maximizing deductions is crucial for reducing taxable income. AI-driven expense categorization helps identify eligible costs, such as travel, equipment, and software. Platforms also offer industry-specific libraries tailored to creatives, consultants, and other professionals.

For instance, Cash App Taxes supports crypto income reporting, ensuring accurate filings for digital assets. These tools help freelancers claim every possible deduction, optimizing their returns.

State and Federal Filing Options

Multi-state filing can be a headache for e-commerce sellers and remote workers. Specialized platforms provide nexus guidance, ensuring compliance across jurisdictions. Real-time error checking for Form 1040-ES vouchers further minimizes risks.

These features not only simplify the process but also ensure accuracy, reducing the likelihood of audits. With the right tools, freelancers can focus on growing their business rather than navigating complex tax laws.

Best Tax Software for Freelancers in 2025

As the freelance economy expands, finding the right financial tools becomes essential. Independent workers need platforms that simplify complex processes while ensuring accuracy and compliance. In 2025, specialized solutions will play a critical role in managing multiple income streams and intricate deductions.

Investopedia ranks H&R Block as the top choice with a 4.8/5 rating, praised for its comprehensive features and reliability. On the other hand, TaxSlayer stands out for affordability, costing 60% less than competitors. Both platforms cater to the unique needs of freelancers, offering tailored solutions for LLCs and sole proprietors.

Key features to consider include pricing tiers, audit guarantees, and entity support. Mobile app availability and receipt-scanning capabilities are also crucial for on-the-go professionals. However, hidden costs like TaxAct’s $64.99 state filing fee can impact overall affordability.

Emerging trends such as AI tax assistants and real-time CPA chat features are transforming the industry. These innovations provide freelancers with instant support and guidance, reducing the risk of errors. For more insights on optimizing your finances, explore this comprehensive guide.

Choosing the right platform depends on your specific needs. Whether you prioritize affordability, advanced features, or excellent customer service, there’s a solution for every small business. By leveraging these tools, freelancers can focus on growing their ventures while staying compliant with tax regulations.

H&R Block: Best Overall for Freelancers

H&R Block stands out as a top choice for freelancers in 2025, offering tailored solutions for managing complex financial obligations. With its comprehensive features and reliable tax preparation, it simplifies the process of filing multiple income streams and intricate deductions.

Pricing and Plans

H&R Block offers plans ranging from $125 to $220, which include up to five federal filings. The Business + Personal bundle is particularly beneficial, covering both Schedule C and W-2 income. Additionally, its $49 state e-file fee is more affordable compared to competitors charging $59-$69.

Pros and Cons

One of the standout features is its audit representation and 60-day amendment support, ensuring accuracy and peace of mind. However, the Basic tier lacks live priority support, which may be a drawback for some users.

For freelancers seeking a reliable solution, H&R Block combines affordability with robust features. To further optimize your financial management, explore this guide on AI-powered expense tracking.

TurboTax: Best for QuickBooks Integration

In 2025, seamless financial management is critical for independent professionals. TurboTax stands out as a powerful software solution, particularly for its integration with QuickBooks. This feature simplifies income tracking and filing, making it a top choice for freelancers.

Integration with QuickBooks

TurboTax’s desktop version syncs effortlessly with QuickBooks Desktop, automating profit and loss statement imports for Schedule C. This eliminates manual data entry, reducing errors and saving time. Real-time bookkeeping reconciliation alerts ensure that your financial records are always up to date.

For freelancers juggling multiple income streams, this integration is invaluable. It provides a clear overview of earnings and expenses, simplifying quarterly payments and year-end filings. To learn more about optimizing your financial tools, explore this guide on performance reviews.

Expert Assistance Options

TurboTax also offers robust help for complex contractor income scenarios. For $50 per session, users can access Live CPA reviews, ensuring accuracy in their filings. Additionally, year-round tax planning webinars are included in the Premium plan, providing ongoing support from expert professionals.

These features make TurboTax a reliable choice for freelancers seeking both automation and professional guidance. By leveraging its advanced tools, independent workers can focus on growing their ventures while staying compliant with tax regulations.

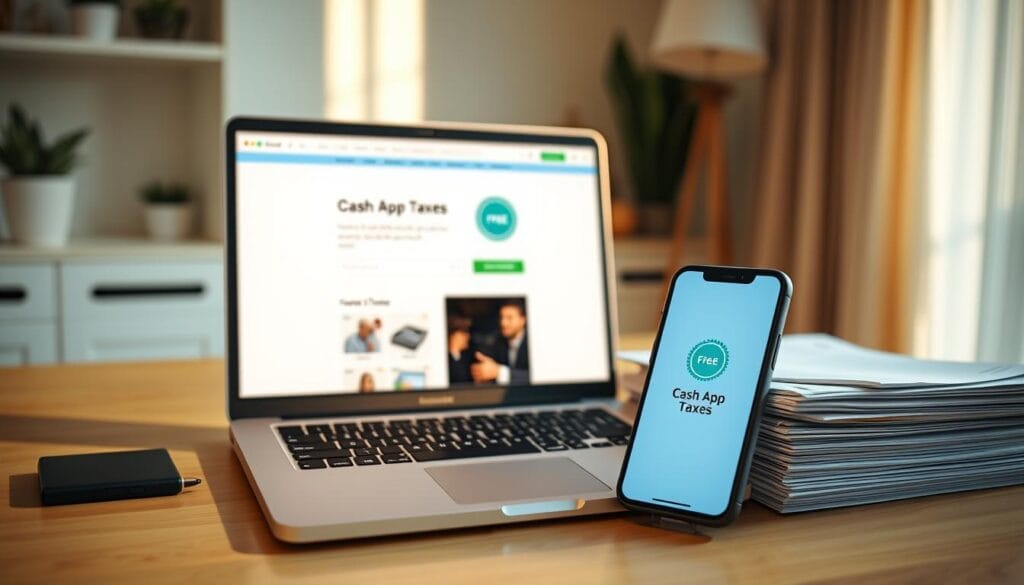

Cash App Taxes: Best Free Option for Freelancers

For freelancers seeking a cost-effective solution, Cash App Taxes offers a compelling choice with its $0 pricing model. This platform is designed to simplify the filing process while ensuring compliance with federal and state requirements. Its unique features cater specifically to independent workers, making it a standout option in 2025.

Free Federal and State Filing

Cash App Taxes eliminates the cost barrier by offering free federal and state filing for all users. This includes support for complex tax forms like Schedule SE and Form 8995, which are essential for freelancers managing business income. Users can also file unlimited amended returns and prior-year filings, ensuring flexibility and accuracy.

Additionally, the platform offers five-day faster refunds via Cash App direct deposit. This feature is particularly beneficial for freelancers who rely on timely payments to manage their cash flow. With over 12 million returns filed for free, Cash App Taxes has proven its reliability and efficiency.

User-Friendly Interface

The platform’s intuitive design makes it easy for freelancers to navigate complex filing processes. A drag-and-drop 1099 uploader simplifies income reporting for gig platforms, while in-app video guides provide step-by-step assistance for freelancer-specific scenarios. These features ensure that even first-time users can file their returns with confidence.

Enhanced security measures, such as 2-factor authentication and encryption, protect sensitive financial data. This level of security is crucial for freelancers who handle multiple income streams and require peace of mind when filing their tax forms.

For freelancers looking to streamline their financial management, Cash App Taxes is a reliable and accessible option. Explore more about its features on the official Cash App Taxes page or discover other tools in this guide on personal finance apps.

TaxSlayer: Best for Affordability

Affordable solutions are crucial for independent workers managing their finances. TaxSlayer stands out as a budget-friendly platform, offering features tailored to the needs of freelancers. Its competitive pricing and robust customer support make it a top choice for those seeking value without compromising on quality.

Competitive Pricing

TaxSlayer’s Self-Employed plan is priced at $72.95, making it an attractive option for freelancers. Early filers can benefit from a 25% discount for submissions in January1. Additionally, the platform charges a flat state fee of $47.95, which is more affordable compared to H&R Block’s variable pricing1.

Customer Support Options

TaxSlayer ensures users have access to reliable assistance with 24/7 email support and a 4-hour response guarantee2. For added peace of mind, freelancers can opt for a $29 add-on that provides unlimited IRS audit guidance2. This feature is particularly valuable for those navigating complex filings.

With its focus on affordability and support, TaxSlayer is a practical choice for freelancers looking to streamline their financial management. Its cost-effective plans and responsive customer support make it a reliable partner for independent workers.

How to Choose the Right Tax Software for Your Needs

With 68% of freelancers overpaying due to unclaimed deductions, choosing the right platform is critical. The right solution not only simplifies filing but also ensures you maximize savings. Start by evaluating your financial situation and comparing available options.

Assess Your Financial Complexity

Understanding your obligations is the first step. Freelancers with foreign income, K-1 forms, or R&D tax credits often require advanced features. For example, those earning over $10,000 in 1099 income may need to upgrade from free platforms to handle complex filings.

Consider tools that support multi-state filings or specialized deductions. Platforms like TurboTax integrate seamlessly with accounting tools, simplifying the process. This ensures you stay compliant while optimizing your returns.

Compare Costs and Features

When evaluating options, analyze both pricing and features. Annual subscriptions may offer better value for freelancers with consistent income, while pay-per-return plans suit those with fluctuating earnings. Be wary of hidden fees, such as bank product charges or printed return costs.

For instance, TaxSlayer offers a 25% discount for early filers, making it a budget-friendly choice. Platforms like H&R Block provide audit support, adding an extra layer of security. For more insights, explore this comprehensive guide.

By carefully assessing your needs and comparing options, you can find a tool that balances affordability and functionality. This ensures you stay compliant while maximizing your savings.

Conclusion

In 2025, freelancers will face evolving financial challenges, making the right tools essential for success. Platforms like H&R Block offer comprehensive solutions, while Cash App Taxes stands out for its budget-friendly approach. Both cater to the unique needs of independent workers, ensuring accurate filing and maximizing deductions.

Audit defense features are critical for freelancers, as errors can lead to costly penalties. Emerging trends like AI-driven deduction finders and IRS API integrations will further simplify the process, providing real-time support and accuracy.

When choosing a platform, consider your income tier and business structure. For advanced needs, explore freelance-focused tools. By leveraging the right tax software, freelancers can focus on growing their ventures while staying compliant with regulations.