Did you know that automated savings tools are now used by over 40% of Americans to manage their finances? This growing trend highlights how technology is reshaping personal finance, making it easier than ever to save and invest.

One of the most innovative solutions in this space is the rise of round-up apps. These platforms leverage behavioral economics to help users save small amounts effortlessly. By rounding up everyday purchases to the nearest dollar, they turn spare change into meaningful savings.

In 2025, the top solutions combine fintech innovation with user-friendly features. Many platforms now offer $250,000 FDIC insurance, ensuring your money is safe. Whether you’re focused on saving or exploring hybrid investment options, these tools are designed to meet diverse financial goals.

For those looking to dive deeper into automated financial tools, check out our guide on low-fee robo-advisors. These platforms complement round-up apps, offering a comprehensive approach to managing your finances.

Key Takeaways

- Automated savings tools are used by over 40% of Americans.

- Round-up apps simplify saving by rounding up everyday purchases.

- Top 2025 platforms combine fintech innovation with user-friendly features.

- $250,000 FDIC insurance is standard across leading solutions.

- Hybrid investment platforms cater to diverse financial goals.

What Are Round-Up Savings Apps?

Modern finance tools are redefining how we manage spare change. These platforms act as a digital evolution of the traditional change jar, applying the same concept to electronic transactions. By connecting to users’ existing bank accounts and payment cards, they automate the process of saving small amounts effortlessly.

These tools track everyday purchases and calculate the difference needed to round up to the nearest dollar. For example, a $3.75 coffee purchase would automatically save $0.25. Over time, these small amounts accumulate into a meaningful savings account.

Integration with existing financial infrastructure is seamless. Users link their credit or debit cards, and the app handles the rest. This ensures compatibility with major banks and payment systems, making it accessible to a wide audience.

To optimize banking fees, most platforms set transfer thresholds between $5 and $10. This means the accumulated money is only moved to your savings account once it reaches this amount. This approach minimizes transaction costs while maximizing efficiency.

Even legacy banks like Bank of America have adopted this innovative way of saving. Their implementation highlights the growing acceptance of automated financial tools in mainstream banking. For more insights into modern financial solutions, explore our guide on automated finance tools.

How Round-Up Savings Apps Work

Understanding the mechanics behind these tools can transform how you manage your finances. By leveraging behavioral economics, they make saving effortless and intuitive. These platforms connect to your checking account or debit card, tracking every transaction to identify opportunities for saving.

The Psychology Behind Spare-Change Savings

Behavioral science plays a key role in these tools. Principles like loss aversion and automation bias encourage users to save without thinking. For example, rounding up a $4.50 purchase to $5 feels like a small, painless step. Over time, these micro-savings add up significantly.

Studies show that even $100 in savings can improve financial well-being. By automating the process, users overcome the status quo bias, making saving a default behavior. This approach minimizes cognitive load, ensuring consistency.

Automated Transfers and Thresholds

These platforms use smart algorithms to transfer funds only when they reach a set threshold, typically between $5 and $10. This minimizes transaction fees while maximizing efficiency. For instance, a $50 monthly investment could grow to over $400,000 in 40 years, assuming a 10% annual return.

Modern tools also include anti-overdraft protections, ensuring users don’t face financial strain. Customizable rounding rules, like rounding to the nearest $1 or $5, allow users to adjust their saving intensity. This flexibility makes these tools accessible to a wide audience.

For more insights into how technology is reshaping personal finance, explore our guide on AI’s impact on money management.

Top Round-Up Savings Apps for 2025

In 2025, financial tools are evolving to make saving and investing more accessible than ever. Leading platforms combine innovative features with user-friendly interfaces, helping users grow their wealth effortlessly.

Acorns: Invest Spare Change with Ease

Acorns stands out with its seamless integration of saving and investment options. For $3 per month, users can access a personal plan that includes a checking account with a 3% APY and a savings account offering 4.52% APY.

The Mighty Oak debit card is a standout feature, providing 3% cashback on purchases. This makes it a powerful tool for those looking to maximize their funds while managing everyday expenses.

Chime: High-Yield Savings with Round-Ups

Chime offers a robust platform with a 2.00% APY on its savings account. Its “Save When You Spend” feature automatically rounds up transactions, making saving effortless.

Additional perks include $200 overdraft protection and early access to payroll via direct deposit. With a network of 60,000 fee-free ATMs, Chime ensures convenience for users on the go.

Qapital: Goal-Based Savings Rules

Qapital caters to users with specific financial goals. Its tiered pricing ranges from $3 to $12 per month, offering flexibility for different budgets.

Unique features like the Freelancer Tax Rule and the 52-Week Challenge help users stay on track. Integration with Apple Health and Spend Less Rules adds a personalized touch to the experience.

For a deeper dive into automated financial tools, explore our robo-advisor comparison guide.

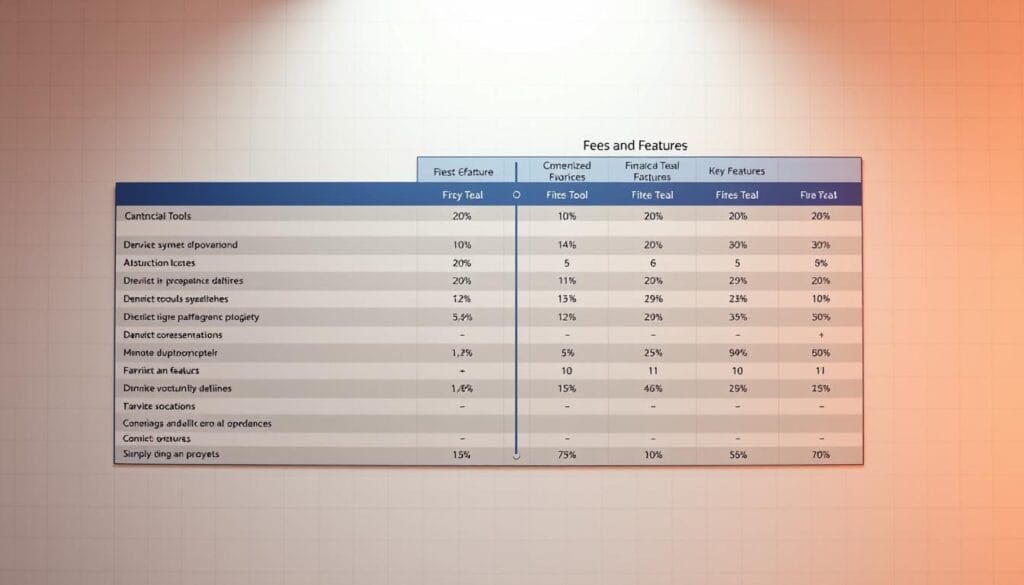

Comparing Fees and Features

When choosing financial tools, understanding the cost structure and features is essential for making informed decisions. Platforms like Oportun, Goodbudget, and Rocket Money offer varying pricing tiers, each with unique benefits.

Monthly Costs vs. Potential Returns

Monthly fees for these services range from $3 to $12, depending on the platform and features. For example, Oportun charges $5 per month after a trial period, while Goodbudget offers unlimited envelopes for $10 per month.

Rocket Money’s premium bill negotiation service costs between $3 and $12 monthly. These fees are often offset by the potential returns, such as higher interest rates on savings accounts or cashback rewards.

FDIC Insurance and Account Safety

Security is a top priority for financial platforms. Most accounts are protected by FDIC insurance, covering up to $250,000 per depositor. This ensures that your funds are safe, even in the event of a bank failure.

Additionally, platforms use 256-bit encryption and biometric logins to safeguard user data. These measures provide peace of mind, knowing your financial information is secure.

Hidden costs, such as ATM fees or withdrawal limits, can impact overall savings. Always review the fine print to avoid unexpected charges. By understanding the services and fees, you can choose the best tool for your financial goals.

Unique Features That Set Apps Apart

Innovative financial platforms are introducing features that redefine convenience and efficiency. These tools are designed to cater to specific user needs, offering specialized functionalities that enhance the overall experience.

Chime’s Early Direct Deposit

Chime stands out with its early direct deposit feature, allowing users to access their payroll up to two days in advance. This service, powered by The Bancorp Bank, provides faster access to funds, helping users manage their finances more effectively.

Additionally, Chime’s Credit Builder Visa® helps users build credit without requiring a credit check. This specialty banking product is ideal for those looking to improve their financial health while enjoying seamless services.

Acorns’ Mighty Oak Debit Card

Acorns offers the Mighty Oak debit card, which combines saving and investing in one tool. Users earn 3% cashback on purchases, making it a powerful option for maximizing everyday spending.

The platform also integrates ESG portfolio options powered by BlackRock ETFs, appealing to socially responsible investors. This feature aligns financial growth with personal values, offering a unique blend of convenience and impact.

Qapital’s Freelancer Tax Rule

Qapital caters to freelancers with its Freelancer Tax Rule, automating tax withholding for 1099 workers. This ensures users set aside cash for taxes with each payment, simplifying financial planning.

Another standout feature is the Rainy Day Weather Trigger, which links savings goals to real-world events. This niche automation adds a creative touch to financial management, making it both practical and engaging.

For more insights into the best financial tools, explore our guide on top money-saving platforms.

Are Round-Up Apps Safe?

Security is a top priority for financial platforms. Leading tools use 256-bit encryption to protect user data, ensuring it remains secure during transactions. This level of encryption is the same standard used by major banks, providing peace of mind for users.

Most platforms partner with FDIC-insured banks, such as Lincoln Savings Bank, to safeguard user funds. This means deposits are protected up to $250,000 per account, offering a safety net in case of bank failure.

Additionally, these tools rely on Plaid API, which holds security certifications for secure data transfer. Plaid ensures that user bank credentials are encrypted and only shared with authorized services.

Regulatory compliance is another critical factor. Platforms offering investment features are overseen by FINRA and the SEC, ensuring they meet strict financial standards. This oversight adds an extra layer of protection for users.

User-controlled permissions are also a key safeguard. Most tools only require read-only access to your account, meaning they cannot initiate transactions. This minimizes the risk of unauthorized activity.

Fraud protection protocols, such as transaction monitoring systems, further enhance security. These systems detect suspicious activity and alert users immediately. For more insights into secure financial tools, visit our blog.

Finally, data privacy policies are transparent, with clear disclosures about third-party sharing. Users can review how their information is used, ensuring full control over their data.

Why Use Round-Up Savings Apps?

Financial tools that automate saving have become a game-changer for many Americans. These platforms simplify the process of setting aside funds, making it easier to save money without constant effort.

One of the key benefits is behavioral modification. By passively transferring small amounts, users develop healthier financial habits. For example, YNAB users report an average first-year savings of $6,000, showcasing the effectiveness of this approach.

These tools also enhance financial literacy. A study found that 78% of users experience improved awareness of their spending habits. This knowledge empowers individuals to make smarter financial decisions.

For first-time investors, these platforms serve as a gateway product. They introduce users to basic investment concepts in a low-risk way. This makes them an excellent starting point for building long-term wealth.

Additionally, they complement budgeting systems like envelope methods. By automating savings, users can allocate funds more efficiently. This synergy accelerates the growth of emergency funds, providing financial security.

For gig economy workers, these tools offer tax optimization features. They help set aside funds for taxes automatically, reducing stress during tax season. To learn more about how these platforms work, explore our guide on auto-saving apps.

Conclusion

The future of personal finance is shaped by automation and innovation. In 2025, tools with advanced features will continue to simplify how people manage their money. Pairing these solutions with high-yield accounts can maximize returns while maintaining security.

Emerging trends, such as AI-driven predictions, will further enhance financial planning. These technologies analyze spending patterns to offer tailored advice, helping users make smarter decisions.

For those new to automation, starting with one or two tools is a practical approach. This allows users to gradually build confidence and develop consistent financial habits. Over time, these small steps can lead to significant progress.

To explore more about optimizing your financial strategy, check out our guide on robo-advisor performance reviews. The right tools can transform your financial future, one automated step at a time.