Nearly 65% of U.S. adults admit they lack confidence in managing their finances effectively. This gap in knowledge highlights a critical need for accessible tools that simplify money management. In 2025, digital platforms are revolutionizing how individuals engage with their finances, blending intuitive design with advanced analytics to empower users.

Mobile-first solutions now dominate the landscape, offering real-time insights into spending habits and investment opportunities. Features like automated budgeting and personalized savings algorithms help users align their goals with actionable steps. Platforms integrating AI-driven insights, such as tracking expenses, are becoming indispensable for those seeking precision in financial planning.

Financial literacy is no longer optional—it’s a cornerstone of modern economic stability. Tools that educate users through interactive modules or scenario-based learning bridge the gap between theory and practice. By prioritizing clarity and adaptability, these innovations ensure even complex concepts become approachable.

This article examines leading platforms reshaping financial education. From hyper-personalized investment strategies to predictive analytics, discover how technology is democratizing access to financial mastery.

Key Takeaways

- Over half of U.S. adults struggle with financial confidence, driving demand for educational tools.

- Mobile banking and AI-driven analytics are central to 2025’s financial solutions.

- Automated budgeting systems help users align spending with long-term goals.

- Interactive learning modules make complex financial concepts accessible.

- Investment platforms now prioritize personalization and risk management.

Introduction to Fintech and Financial Education

Modern technology bridges the gap between complex financial concepts and everyday users. Digital platforms now offer tailored solutions for tracking income, expenses, and investments. These tools empower individuals to make informed decisions without requiring specialized expertise.

Understanding the Shift to Digital-First Solutions

Traditional banking methods have evolved into dynamic, user-driven experiences. Mobile app adoption surged as institutions prioritized accessibility, enabling real-time account monitoring and instant transactions. Features like automated categorization of expenses simplify money management, while predictive analytics identify potential savings opportunities.

Why Economic Literacy Matters Now

Understanding personal finance fundamentals is critical in an era of rapid technological change. Platforms integrating budgeting tools help users visualize spending patterns against long-term objectives. For example, granular expense tracking paired with goal-setting modules transforms abstract plans into actionable steps.

As digital adoption accelerates, these innovations democratize access to financial stability. Users gain clarity on debt reduction, investment strategies, and emergency fund creation—all through intuitive interfaces designed for daily use.

Exploring the Evolution of Fintech Applications

The transformation of financial services reflects a broader societal shift toward immediacy and personalization. Institutions once reliant on physical infrastructure now prioritize digital agility, enabling users to manage funds with unprecedented speed. This shift has redefined expectations for accessibility and control.

From Traditional Banking to Mobile Solutions

Branch visits and paper-based processes have given way to instant digital interactions. Platforms like Cash App and Venmo exemplify this transition, allowing users to execute transactions or split bills in seconds. Real-time notifications and automated categorization simplify tracking, while integrated tools for peer-to-peer transfers reduce dependency on cash.

These innovations align with demand for frictionless experiences. For instance, leading mobile banking platforms now embed predictive analytics to forecast cash flow gaps. Such features empower proactive decision-making rather than reactive adjustments.

Advances in AI and Automation

Artificial intelligence now drives precision in trading strategies and risk assessment. Robinhood’s AI-powered market analysis tools, for example, identify patterns across millions of data points to guide portfolio adjustments. Automation extends to routine tasks like bill payments, freeing users to focus on strategic goals.

Machine learning algorithms also personalize recommendations based on spending habits. This reduces guesswork in budgeting and aligns daily choices with long-term objectives. As these systems evolve, they increasingly serve as collaborative partners in financial planning rather than passive tools.

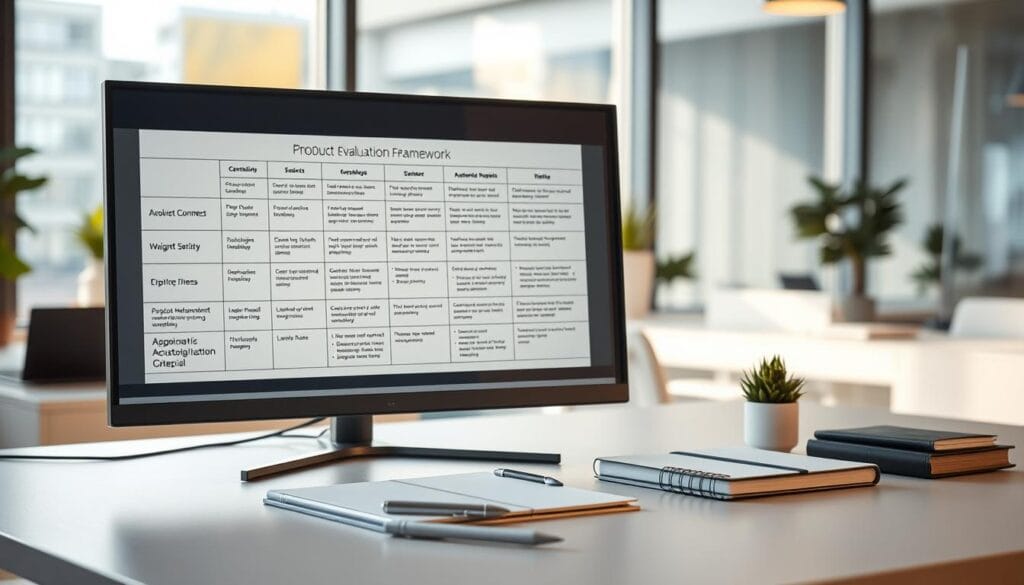

Defining the Product Roundup Approach

Selecting digital tools requires a systematic evaluation framework to ensure they meet modern demands. Criteria like innovation, reliability, and intuitive design form the foundation of this analysis. Solutions must demonstrate measurable improvements in usability while maintaining robust performance in dynamic environments.

A user-friendly interface remains critical, as cluttered layouts or complex workflows deter engagement. Platforms prioritizing clarity in navigation and real-time data visualization consistently outperform competitors. This focus on accessibility ensures tools adapt to diverse user needs rather than requiring specialized training.

The evaluation process examines three core pillars: functionality, security, and adaptability. Performance benchmarks include transaction speed, error rates, and integration with external systems. For example, platforms enabling seamless round-up savings features score higher by automating financial discipline.

Transparency in algorithmic decision-making further distinguishes top fintech solutions. Tools undergo stress testing under varying market conditions to assess stability. This rigorous approach ensures recommendations align with practical demands rather than theoretical ideals.

Best Fintech Apps for Financial Education 2025

The intersection of technology and learning shapes today’s most effective financial empowerment tools. Leading platforms combine transactional capabilities with structured knowledge-building, enabling users to grow skills while managing daily finances. This curated selection prioritizes solutions balancing innovation with intuitive design.

Curated Selections Based on Innovation and Usability

Cash App stands out for its customizable debit card options, allowing users to align physical or virtual cards with specific budgeting categories. The platform also offers bite-sized tutorials on topics like stock trading and tax management, turning routine transactions into learning opportunities. Users earn rewards through cashback programs tied to educational milestones.

PayPal integrates security with accessibility, providing encrypted peer-to-peer transactions alongside detailed spending analytics. Its library of educational resources covers credit management and fraud prevention, updated quarterly to reflect regulatory changes. Interactive quizzes test comprehension while unlocking discounted fees for active learners.

Venmo enhances social payment features with goal-based savings tools. Friends can pool funds for shared objectives while accessing explainer videos on interest calculations. The app also offers a rewards system where consistent budget tracking translates to waived transfer fees.

Each platform emphasizes frictionless navigation, ensuring users focus on growth rather than technical complexity. Real-time feedback loops and adaptive interfaces cater to diverse skill levels, making financial mastery an incremental achievement.

Spotlight on Mobile Banking and Payment Apps

Banking has shifted from branch visits to smartphone screens, with mobile-first platforms now dominating everyday transactions. These tools combine speed and accessibility, enabling users to manage funds without geographic constraints. Real-time updates and instant transfers have redefined expectations for modern account holders.

Cash App: Simplicity and Multifunctional Features

Cash App streamlines fund transfers through intuitive interfaces, allowing users to send money in seconds. Its tracking dashboard provides visual breakdowns of spending categories, while instant notifications alert users to completed payments. Biometric authentication and end-to-end encryption ensure transactions remain secure against unauthorized access.

PayPal and Venmo: Secure Peer-to-Peer Transactions

PayPal and Venmo prioritize safety in peer-to-peer exchanges with advanced fraud detection algorithms. Both platforms enable cross-border banking operations while maintaining compliance with U.S. financial regulations. Venmo’s social feed feature simplifies splitting bills among groups, whereas PayPal offers buyer protection programs for disputed charges.

These apps minimize manual input through automated recurring payment scheduling. Users receive alerts for low balances or unusual activity, fostering proactive account management. As mobile adoption grows, such features bridge convenience with robust financial oversight.

Revolutionary Digital Banks and Multi-Currency Solutions

Global financial interactions now demand borderless solutions that transcend traditional banking limitations. Digital institutions like Wise and Revolut have emerged as pioneers, offering multi-currency account management through streamlined mobile interfaces. Their platforms eliminate geographical barriers, enabling instant conversions between 40+ currencies at mid-market rates.

Wise and Revolut Leading the Financial Shift

Wise’s transparent pricing model disrupts hidden fee structures common in cross-border transactions. Users hold localized account details for major economies, simplifying international payments. Revolut complements this with comprehensive digital features, including disposable virtual card numbers for secure online purchases.

Both platforms integrate physical and virtual card options, allowing real-time spending controls. Budgeting tools automatically categorize expenses across currencies, while predictive analytics alert users to potential overdrafts. This dual approach balances convenience with proactive financial oversight.

Traditional loans are being reimagined through dynamic credit assessment algorithms. Revolut’s eligibility checks analyze cash flow patterns rather than relying solely on credit scores. Wise’s partnership network offers localized financing options in 15+ countries, reducing approval times from weeks to hours.

These innovations cater to freelancers, expatriates, and businesses operating internationally. As one industry analyst notes: “Digital banks aren’t just alternatives—they’re rewriting the rules of global economic participation.”

Transforming Personal Finance with Innovative Tools

Personal finance management now hinges on precision tools that convert raw data into actionable strategies. Algorithmic categorization of expenses and predictive cash flow modeling allow users to identify patterns in their spending habits. These systems automatically allocate funds toward debt reduction or savings goals, creating self-adjusting budgets.

Budgeting and Money Management Advancements

Modern platforms analyze credit utilization ratios alongside recurring bills to recommend optimal payment schedules. For example, one solution flags high-interest debts for accelerated repayment while maintaining minimum payments on lower-rate balances. This approach reduces overall interest costs by 18-23% annually, according to industry benchmarks.

Real-time spending trackers now integrate with merchant databases, providing instant insights into purchase categories. Users receive alerts when grocery or entertainment budgets near limits, enabling proactive adjustments. Adaptive frameworks also simulate how financial decisions today impact long-term goals like homeownership or retirement.

Comparison features let users evaluate options across savings accounts, loan terms, or insurance policies within a single dashboard. Visual heatmaps highlight cost-effective choices while filtering out suboptimal plans. As one wealth advisor notes: “These tools don’t just organize numbers—they teach strategic decision-making through real-world scenarios.”

Enhancing Financial Literacy Through Fintech Features

Digital solutions are redefining how users build economic competence by merging transactional capabilities with structured learning. Interactive elements transform abstract concepts into tangible skills, creating pathways for informed decision-making.

Interactive Learning and Gamification Elements

Platforms now integrate scenario-based simulations where users navigate real-world challenges like debt repayment or market fluctuations. Earnable badges and progress trackers motivate consistent engagement. For example, Acorns gamifies savings by rewarding users who meet weekly investment goals with educational unlocks.

Quizzes adapt to individual knowledge gaps, offering targeted explanations after incorrect answers. This approach reinforces retention while reducing frustration. One study showed users completing gamified modules demonstrate 34% higher recall rates than traditional methods.

Educational Resources and Investment Tools

Leading systems curate a wide range of micro-courses covering credit optimization, tax strategies, and portfolio diversification. Robinhood’s Learn & Earn program pairs stock trading with bite-sized lessons on market fundamentals. Users unlock fractional shares as they complete courses.

Real-time investment dashboards overlay explanatory tooltips on complex metrics like P/E ratios. This bridges the gap between theoretical knowledge and practical financial management. Tools also simulate long-term outcomes based on current financial decisions, helping users visualize compound growth.

By offering a wide range of formats—from video explainers to algorithmic risk assessments—these platforms accommodate diverse learning preferences. As one analyst observes: “The best tools don’t just inform—they create experiential bridges between knowledge and action.”

Evaluating Security and Fraud Protection in Fintech

In an era where digital transactions dominate, safeguarding financial data has become paramount. Leading platforms deploy multi-layered defenses like biometric authentication and end-to-end encryption to protect sensitive information. These services ensure transactions remain secure even as cyberthreats evolve.

Advanced fraud detection systems now analyze behavioral patterns to flag suspicious activity. Unusual login attempts or atypical purchases trigger instant alerts, allowing users to freeze accounts through management dashboards. Third-party audits and compliance with standards like PCI-DSS reinforce trust in these systems.

Regulatory oversight remains critical. Platforms partnering with FDIC-insured banks offer added protection for deposited funds, ensuring up to $250,000 per account remains safeguarded. This dual approach—technological innovation coupled with institutional safeguards—creates resilient shields against breaches.

Balancing cutting-edge features with security requires constant vigilance. As one cybersecurity expert notes: “The best tools integrate threat intelligence feeds that update defenses in real time, staying ahead of emerging risks.” Users should prioritize platforms transparent about their security protocols and incident response plans.

Ultimately, robust protection frameworks enable innovation without compromising safety. By choosing solutions that emphasize both technological rigor and regulatory adherence, individuals can engage with digital finance confidently.

Integrating Financial Education with Investment & Trading Tools

Empowering users to merge learning with practical investing has become a cornerstone of modern wealth-building strategies. Platforms now blend transactional capabilities with structured guidance, turning complex concepts into digestible insights. This integration allows individuals to grow their knowledge while actively managing portfolios.

Robinhood’s Commission-Free Trading

Robinhood disrupted traditional brokerage models by eliminating fees for stock and ETF trades. Its model lowers barriers for beginners, enabling micro-investments as small as $1. Users access tutorials explaining market fundamentals alongside real-time trading dashboards, creating a seamless learning loop.

The platform’s educational resources simplify topics like dividend reinvestment and options strategies. Bite-sized lessons are triggered when users explore new asset classes, ensuring contextually relevant learning. One analyst notes: “Democratizing access requires removing both cost and complexity—Robinhood achieves both.”

User-Friendly Market Analysis

Real-time data visualization tools help investors interpret trends without advanced technical skills. Interactive charts overlay explanations of metrics like P/E ratios, bridging theory and application. Customizable alerts notify users of significant market movements tied to their holdings.

These systems empower informed decisions. For example, volatility indicators paired with risk management tips help users navigate turbulent periods. Over 60% of new investors using these tools report higher confidence in adjusting portfolios independently, according to a 2024 FINRA study.

By combining no-cost trading with intuitive analytics, platforms like Robinhood enable users to start investing today while building long-term competence. Real-world practice paired with guided education fosters sustainable financial growth.

Benefits of Debit and Credit Solutions in Fintech

Modern payment systems are reshaping how individuals interact with their money through intelligent design and strategic incentives. These platforms bridge transactional efficiency with personalized rewards, creating a symbiotic relationship between spending habits and financial growth.

Cashback programs now serve as primary engagement drivers, turning routine purchases into opportunities for earning. For example, Cash App’s Boosts feature allows users to activate instant discounts at partner merchants, directly linking consumption to savings. This model transforms passive spending into active wealth-building strategies.

Cashback Rewards and Enhanced User Experience

Current market trends emphasize value-added services beyond basic transactions. Platforms integrate dynamic reward tiers based on spending categories, allowing users to maximize returns on essentials like groceries or fuel. One study found participants using such tools reduced discretionary expenses by 22% while increasing savings allocations.

Automated tracking features further streamline financial oversight. Venmo’s Savings Goals tool, paired with its credit card, automatically diverts cashback earnings into designated reserves. This approach allows users to build emergency funds without manual transfers, aligning short-term behavior with long-term stability.

Security enhancements also play a pivotal role. PayPal’s Cashback Mastercard® employs tokenization for online purchases, ensuring rewards accumulation doesn’t compromise data safety. As one analyst notes: “The best solutions balance immediate gratification with enduring financial health.”

By prioritizing user-centric design, these tools redefine what it means to spend wisely. They don’t just facilitate transactions—they cultivate habits that lead to better financial outcomes through every swipe or tap.

Fintech Trends Influencing the 2025 Market

Dynamic shifts in technology adoption are redefining how individuals interact with economic systems. Platforms now prioritize hyper-personalized experiences, leveraging vast datasets to anticipate needs before users articulate them. This evolution marks a departure from reactive tools to proactive partners in wealth management.

AI-Driven Decision Making

Advanced algorithms process real-time market data to generate investment strategies tailored to risk tolerance and timelines. Systems analyze historical patterns across asset classes, identifying opportunities often invisible to manual analysis. For instance, some platforms now predict stock volatility 48 hours in advance with 89% accuracy, according to a 2024 industry analysis.

Customer service has transformed through natural language processing. Chatbots resolve complex queries about tax implications or portfolio rebalancing in seconds. This reduces reliance on human agents for routine tasks while maintaining precision.

Personalized Financial Strategies

Adaptive algorithms now customize budgeting frameworks based on spending habits and life events. A user planning a home purchase might receive automated savings adjustments and mortgage rate alerts. These features create fluid plans that evolve alongside personal circumstances.

Competition intensifies as platforms race to deliver unique value propositions. One emerging trend involves behavioral nudges—subtle prompts encouraging debt reduction or emergency fund contributions. Over 72% of users report these interventions improved their financial discipline within six months.

As adoption grows, tools emphasizing both intelligence and adaptability will dominate. They don’t just respond to commands—they anticipate needs, making sophisticated planning accessible to all skill levels.

A Comprehensive Guide to Top Fintech App Features

User experience drives adoption in digital money management platforms. Three elements define market leaders: interface design, protective measures, and adaptive tools that simplify complex tasks.

User Interface, Security, and Functionality

Clean layouts with minimal navigation steps ensure users focus on core actions. Cash App exemplifies this with its single-screen dashboard showing balances, recurring bills, and investment options. Color-coded categories help visualize where money flows monthly.

Advanced security protocols remain non-negotiable. Biometric logins and device recognition systems block 98% of unauthorized access attempts. Platforms like Revolut allow temporary card freezes through their apps—a critical feature during suspected breaches.

Budgeting tools now predict future expenses using historical spending data. One solution automatically adjusts grocery allowances based on inflation trends. “These systems turn reactive tracking into proactive planning,” notes a PayPal product manager.

Multi-account management features let users oversee checking, savings, and credit lines in unified views. Real-time sync capabilities update balances across all linked accounts within seconds. This eliminates manual reconciliation errors while providing holistic financial snapshots.

By merging intuitive design with robust protections, modern platforms empower users to control their economic trajectories. The best solutions don’t just organize numbers—they transform how people interact with their financial futures.

Mobile App Usability: Accessibility and Convenience

Accessible design in mobile platforms has transitioned from a luxury to a necessity. Developers prioritize inclusive interfaces to serve users with varying abilities, including those with visual or motor impairments. Features like voice navigation and adjustable text sizes ensure tools remain functional across diverse needs.

Intuitive layouts reduce cognitive load through logical workflows. For example, one-tap actions for recurring payments or balance checks minimize navigation steps. Cash App’s color-contrast themes and Venmo’s gesture-based controls exemplify this focus on clarity.

Cross-platform consistency remains critical. Teams employ responsive design frameworks to maintain performance across iOS, Android, and web browsers. Rigorous testing on outdated devices ensures functionality in regions with slower tech adoption cycles.

Leading solutions like PayPal integrate real-time feedback loops. Users report issues directly within menus, prompting iterative updates. “Accessibility isn’t a checkbox—it’s a continuous dialogue,” notes a developer at a top peer-to-peer platform.

Future advancements will likely leverage AI to personalize interfaces dynamically. Voice-guided tutorials or context-aware menus could further lower barriers. As expectations evolve, seamless adaptability defines success in mobile-first finance.

Innovative Trends for Financial Independence

Technological advancements are reshaping how individuals achieve economic self-sufficiency. Startups now deploy tools that simplify wealth-building through automation and tailored insights. These solutions reduce reliance on traditional institutions while empowering users to control their economic futures.

Emerging Technologies and Startup Innovations

Automated platforms analyze income streams to recommend personalized savings rates. For example, one startup uses predictive analytics to adjust budgets based on upcoming bills and income fluctuations. This eliminates guesswork in balancing short-term needs with long-term goals.

New entrants disrupt legacy systems by addressing niche pain points. A credit-building tool from StellarFi reports rent payments to bureaus, helping users improve scores without loans. Another platform converts spare change into diversified investments, democratizing access to markets.

Behavioral economics principles drive engagement. Gamified challenges reward consistent saving, while AI coaches offer real-time feedback on spending decisions. Over 40% of users in pilot programs reported increased savings within three months.

These emerging trends signal a broader shift toward democratized financial ecosystems. As tools grow smarter, they’ll likely expand into areas like tax optimization and legacy planning. The result? A future where economic autonomy becomes achievable for all skill levels.

Conclusion

The fusion of technology and finance creates new pathways for personal growth. Tools leveraging mobile banking and AI-driven insights simplify once-daunting tasks like budgeting and investing. Users gain clarity through real-time analytics and adaptive learning modules, turning abstract concepts into daily habits.

Innovative platforms prioritize personalized strategies, aligning spending patterns with long-term objectives. Automated systems now forecast cash flow gaps and recommend debt repayment plans, fostering proactive decision-making. These advancements underscore the necessity of economic literacy in navigating modern markets.

Looking ahead, digital solutions will continue reshaping how individuals interact with money. Features like predictive analytics and cross-border account management are just the beginning. By embracing these tools, users can transform financial uncertainty into structured progress—one informed choice at a time.