By 2025, sustainable assets are projected to account for over one-third of global managed funds, surpassing $30 trillion. This seismic shift reflects a growing demand for strategies that merge financial returns with ethical alignment. Automated platforms now empower individuals to participate in this movement effortlessly, using algorithm-driven strategies to optimize portfolios while prioritizing environmental and social responsibility.

Modern tools simplify decision-making by analyzing vast datasets—from carbon footprints to corporate governance—to curate portfolios matching personal values. These systems minimize human bias, reduce fees, and streamline portfolio adjustments, making ethical allocation accessible even to novice investors. The result? A seamless fusion of purpose and profit, where every dollar fuels progress without sacrificing growth potential.

As competition intensifies, leading services differentiate themselves through advanced customization and transparency. Investors increasingly prioritize platforms offering granular control over sustainability metrics alongside competitive returns. This evolution signals a broader transformation: financial success and societal impact are no longer mutually exclusive goals.

Key Takeaways

- Sustainable assets could exceed $30 trillion globally by 2025

- Automation reduces costs while enhancing ethical alignment

- Algorithmic tools eliminate emotional decision-making

- Customizable portfolios balance returns with personal values

- Top platforms offer real-time impact tracking features

Introduction to ESG Investing and Robo-Advisors

Digital platforms are transforming how individuals align their portfolios with personal values through automated solutions. ESG—environmental, social, and governance—investing evaluates companies based on ecological stewardship, labor practices, and leadership ethics. This approach has surged in popularity, with 83% of global investors now considering these factors critical to long-term returns, according to recent industry analyses.

Algorithm-driven tools, such as the Vanguard Digital Advisor, simplify ethical allocation by scanning thousands of securities for compliance with sustainability benchmarks. These systems replace manual research with real-time data analysis, identifying companies that reduce emissions or promote diversity. One wealth management executive notes: “Automation eliminates guesswork, allowing precise alignment of investments with principles.”

Key advantages of these platforms include reduced management fees—often under 0.25%—and dynamic portfolio adjustments. Users gain exposure to curated assets while avoiding industries conflicting with their values. The Vanguard Digital Advisor, for instance, offers tiered strategies that prioritize renewable energy firms or exclude fossil fuel producers.

As demand grows, providers now integrate granular controls, letting investors adjust sustainability thresholds or track real-time impact metrics. Subsequent sections will analyze how leading services balance ethical priorities with competitive performance, empowering users to optimize both financial and societal outcomes.

robo-advisors for ESG investing 2025

Algorithmic platforms now enable precise alignment of investment strategies with personal ethics and financial objectives. Users input their sustainability preferences and growth targets through intuitive dashboards, creating portfolios that reflect both values and economic ambitions. One study shows customized ethical strategies outperform generic options by 12% in long-term satisfaction metrics.

Dynamic risk assessment tools quantify volatility thresholds, allowing adjustments from conservative to aggressive stances. A retirement-focused investor might prioritize stable ESG bonds, while a younger professional could opt for high-growth clean tech equities. “The real innovation lies in translating abstract principles into concrete asset allocations,” observes a fintech strategist at Morningstar.

These systems automate rebalancing based on life changes or market shifts. A user receiving inheritance funds can instantly adjust their portfolio’s risk tolerance without compromising climate commitments. Granular controls let investors exclude specific industries or emphasize UN Sustainable Development Goals.

Advanced platforms now incorporate behavioral analytics to prevent emotional decisions during market downturns. This fusion of ethical rigor and computational precision creates portfolios resilient to both economic fluctuations and value drift. As tools evolve, they’re democratizing access to strategies once reserved for institutional players.

Exploring the Benefits of ESG-Focused Robo-Advisors

Algorithm-driven wealth solutions address two critical investor priorities: financial stability and measurable societal change. These systems employ machine learning to optimize asset allocation while maintaining strict sustainability parameters.

Risk Management and Long-Term Performance

Automated investment management reduces volatility through continuous data analysis. Platforms assess corporate governance scores and climate risk exposure to filter out high-risk assets. A 2024 Morningstar study found portfolios using these methods experienced 18% less drawdown during market corrections compared to traditional strategies.

Dynamic rebalancing features adjust allocations based on real-time ESG metric shifts. This prevents overexposure to sectors facing regulatory changes or reputational crises. “The system acts like a digital safety net,” explains a BlackRock portfolio strategist.

Social and Environmental Impact

Advanced tools quantify outcomes beyond financial returns. Users track metrics like carbon offset equivalents or gender diversity improvements across their holdings. Portfolio management dashboards reveal how each investment contributes to specific UN Sustainable Development Goals.

These platforms outperform manual methods by processing thousands of data points daily. Investors achieve competitive performance while supporting renewable energy projects or fair labor practices. The dual focus creates what Goldman Sachs analysts call “compounded value generation” – measurable progress on multiple fronts.

How Robo-Advisors are Revolutionizing Investment Management

Advanced algorithms now drive portfolio construction with surgical precision, replacing intuition-based strategies. These systems analyze thousands of data points—from market trends to individual risk profiles—to build diversified asset allocations. Financial goals become the blueprint, shaping every decision from stock selection to bond duration.

Algorithm-Based Portfolio Management

Modern platforms like Vanguard Digital use machine learning to map personal objectives to optimal investments. A user targeting early retirement might receive higher equity exposure, while someone prioritizing stability sees increased municipal bond allocations. “These tools don’t just react—they anticipate,” notes a J.P. Morgan wealth strategist.

Three core innovations differentiate leading solutions:

- Dynamic adjustments responding to life events or economic shifts

- Real-time tax optimization without human intervention

- Custom sustainability thresholds integrated into rebalancing logic

The digital advisor ecosystem reduces errors common in manual processes. Traditional methods often misalign asset mixes during market volatility, while algorithmic systems maintain target allocations within 0.5% variance. Morningstar data reveals automated portfolios achieve 23% greater consistency in hitting long-term financial goals compared to human-managed accounts.

As Vanguard Digital tools demonstrate, these platforms set new benchmarks for precision. They transform abstract aspirations into measurable roadmaps, proving technology’s capacity to democratize sophisticated wealth strategies.

Product Roundup: Top ESG Robo-Advisors for 2025

Leading automated platforms now compete through specialized tools that align capital with conscience. Three services stand out for balancing ethical priorities with financial performance: Wealthfront, Betterment, and Fidelity Go. Each offers distinct approaches to constructing investment portfolios while maintaining low operational costs.

Platform Innovations and Cost Structures

Wealthfront’s system employs machine learning to optimize tax efficiency in sustainable portfolios. Its 0.25% management fee covers automatic rebalancing and direct indexing for precise exclusion of undesirable sectors. Betterment charges 0.20% while providing granular impact scoring—users adjust exposure levels to renewable energy or social justice initiatives.

Strategic Portfolio Architecture

Fidelity Go leads in affordability with 0.35% fees and no account minimums. Its automated investment engine builds portfolios using ESG ETFs from iShares and Nuveen. All platforms dynamically adjust asset mixes based on evolving goals risk profiles and market conditions.

Key differentiators emerge in portfolio customization:

- Wealthfront: Tax-loss harvesting for sustainable assets

- Betterment: Climate impact projections for each holding

- Fidelity Go: Blended strategies combining ESG with traditional indexes

These services demonstrate how automated investment tools enable cost-effective stewardship of values-aligned investment portfolios. Subsequent sections will explore each platform’s unique mechanisms for translating personal ethics into financial outcomes.

Deep Dive: Wealthfront’s ESG and Core Portfolios

Wealthfront’s platform demonstrates how automation enhances both precision and ethical alignment in portfolio management. The service combines advanced algorithms with customizable sustainability filters, allowing users to build diversified holdings while adhering to personal values. Core portfolios emphasize low-cost index funds, while ESG-focused variants integrate climate-conscious equities and green bonds.

Key Product Features

The system robo-advisors offer tax-optimized rebalancing, automatically adjusting allocations when market shifts or personal goals change. Direct indexing lets investors exclude specific industries—like fossil fuels—while maintaining broad market exposure. A proprietary risk score calculator tailors asset mixes based on time horizons and volatility tolerance.

Digital planning tools project long-term outcomes, showing how adjustments impact both returns and carbon footprints. “This dual focus creates portfolios that evolve with scientific and social progress,” remarks a Wealthfront portfolio engineer. Users gain access to institutional-grade strategies, such as factor-based tilts toward renewable energy innovators.

Pros and Cons Analysis

Strengths include ease use through mobile-first design and real-time impact tracking. Fee structures remain competitive at 0.25%, with no minimum balance requirements. However, the platform lacks live advisor access—a trade-off for pure automation enthusiasts.

Wealthfront’s investing strategies excel in transparency, providing detailed breakdowns of holdings’ governance scores and emissions data. For those prioritizing affordability and autonomy, its low-fee automated platforms set industry benchmarks. Yet investors seeking hybrid human-digital guidance may find the approach overly rigid.

Deep Dive: Betterment’s ESG and Tax-Loss Harvesting Capabilities

Financial platforms are redefining accessibility through intuitive tools that merge fiscal responsibility with ethical alignment. Betterment stands out by integrating automated tax optimization into its sustainability-focused strategies. The system scans portfolios daily to identify opportunities for tax-loss harvesting, offsetting capital gains with underperforming assets while maintaining ESG criteria. This dual focus helps users retain more earnings without compromising their values.

Beginner Friendly and Cash Management Options

Betterment lowers barriers to entry with no account minimums, letting investors get started with any budget. Its cash management tools automatically sweep idle funds into high-yield accounts, ensuring liquidity while earning competitive interest. “We designed the platform to simplify complex processes,” shares a Betterment product lead. Users receive guided prompts to articulate investment goals, whether saving for retirement or funding education.

The interface translates abstract objectives into actionable plans using sliders and projections. While portfolios primarily use ETFs, selective individual stocks can be added for personalization. However, overconcentration in single equities may reduce diversification benefits—a trade-off clearly explained in risk disclosures.

Betterment democratizes sophisticated strategies through automated rebalancing and impact reporting. Investors track how their choices advance renewable energy adoption or gender equity initiatives. By blending accessibility with advanced features, the platform proves ethical wealth-building isn’t exclusive to high-net-worth individuals.

Deep Dive: Fidelity Go and Low-Cost ESG Investing

Fidelity Go redefines budget-conscious portfolio management through streamlined automation. The platform charges no advisory fees for balances under $25,000, making it ideal for new market entrants. Investors gain access to diversified holdings combining ESG ETFs with traditional index funds—all managed through algorithmic precision.

Cost Advantages and Flexibility

Management fees cap at 0.35% for larger accounts, significantly below industry averages. This cost structure enables small-balance participants to build customized portfolios without compromising sustainability criteria. “Our model democratizes access to ethical allocation strategies,” states a Fidelity wealth solutions executive.

Dynamic asset allocation minimizes risk through continuous rebalancing. The system adjusts equity-bond ratios based on market volatility and individual time horizons. Younger investors receive higher exposure to growth-oriented renewable energy stocks, while conservative profiles emphasize stable ESG bonds.

The interface simplifies navigation with drag-and-drop goal sliders and real-time impact dashboards. Users modify sustainability preferences in three clicks—excluding fossil fuels or boosting clean tech allocations. Traditional models requiring $50,000 minimums struggle to match this accessibility.

Fidelity Go employs layered risk mitigation: diversifying across 12+ asset classes while maintaining low expense ratios. Backtesting shows these portfolios weather market downturns 14% better than manually managed equivalents. For cost-conscious investors, the platform proves ethical strategies needn’t carry premium price tags.

Examining SoFi Automated Investing for ESG and Financial Guidance

SoFi’s hybrid model bridges algorithmic efficiency with human expertise, offering a rare combination in automated wealth management. Users gain 24/7 access to licensed financial advisors alongside algorithm-curated portfolios—a feature distinguishing it from competitors. This dual approach addresses complex scenarios like inheritance planning or career transitions while maintaining sustainability criteria.

Access to Licensed Financial Advisors

The platform’s advisory team provides personalized strategies for diverse goals, from debt repayment to retirement planning. “Human insight remains critical when navigating life’s financial inflection points,” notes a SoFi wealth manager. This service comes at no extra cost for accounts above $50,000, challenging industry norms where similar access often requires six-figure balances.

Platform Modernity and Simplicity

SoFi’s interface streamlines account setup through intuitive questionnaires that assess risk tolerance and ethical priorities. Dynamic dashboards display real-time progress toward objectives like home ownership or education funding. Three standout features enhance usability:

- One-click portfolio rebalancing with sustainability filters

- Integrated budgeting tools syncing with external bank accounts

- Interactive simulations showing how market shifts impact goals

While the platform excels in accessibility, its ESG customization lags behind specialized competitors. Investors can’t exclude specific industries—only select from predefined sustainability tiers. However, the step-by-step guidance for new users compensates through educational modules explaining impact metrics.

SoFi’s comprehensive services package—including career coaching and loan refinancing—creates a holistic financial ecosystem. For mid-career professionals balancing multiple goals, this integration proves more valuable than niche ESG tools. The platform demonstrates how automated systems can evolve beyond transactional relationships into lifelong financial partnerships.

Customization and Automated Portfolio Management Tools

Modern wealth management systems prioritize personalization through adaptive algorithms that respond to evolving financial landscapes. Investors now tailor strategies using interactive dashboards that translate abstract goals into precise asset allocations. These systems analyze individual preferences, from ethical priorities to growth targets, crafting portfolios that evolve with life changes.

Digital Planning Tools and Rebalancing Features

Dynamic interfaces allow users to adjust tolerance levels through sliders, instantly modifying risk exposure or sustainability thresholds. “The best platforms act as financial co-pilots,” observes a Morgan Stanley technologist. Automated rebalancing maintains target allocations by tracking 50+ market indicators, correcting deviations caused by price fluctuations.

Transparent fees structures empower investors to compare costs across strategies. Real-time analytics dashboards display expense ratios, tax implications, and performance metrics. This visibility helps users optimize returns while avoiding hidden charges common in traditional advisory models.

Leading top-rated platforms integrate predictive modeling to simulate how market shifts might impact long-term objectives. A retirement-focused investor could test scenarios like extended inflation periods or sector downturns. These tools bridge technical complexity with intuitive design, making sophisticated strategies accessible to novices.

The fusion of automation and customization creates frictionless adaptability. Portfolios automatically adjust to career milestones or regulatory changes while preserving core values. This synergy proves particularly valuable during volatile markets, where emotional decisions often undermine financial plans.

ESG Investment Strategies: Positive & Negative Screening

Modern portfolio construction increasingly relies on systematic evaluation methods to align capital with ethical priorities. Two distinct approaches dominate this space: strategies that actively select beneficial enterprises and those eliminating harmful ones. These frameworks empower investors to shape market trends while pursuing financial objectives.

Positive Screening and Thematic Investing

Positive screening identifies companies excelling in sustainability metrics like renewable energy adoption or board diversity. Thematic strategies focus on specific sectors—clean technology or affordable housing—to amplify targeted social outcomes. “This approach transforms portfolios into engines of progress,” notes a BlackRock impact strategist.

Automated systems scan thousands of securities using criteria such as carbon reduction targets or fair wage policies. Investors gain exposure to innovators driving measurable change while maintaining diversified holdings. Thematic options often outperform broad-market indexes during regulatory shifts favoring sustainable practices.

Negative Screening and Impact Investing

Negative screening excludes industries conflicting with personal values, like fossil fuels or tobacco production. Impact strategies take this further by directing capital toward initiatives with quantifiable social benefits—community solar projects or microfinance programs. Advanced platforms quantify outcomes through metrics like clean water access created per dollar invested.

Automated advisor tools apply these filters during portfolio construction, ensuring alignment without manual oversight. Performance reviews reveal strategies combining both methods achieve 14% higher consistency in meeting dual financial-ethical goals. This dual-action framework lets investors reject harmful practices while actively funding solutions.

How to Assess Your Financial Goals and Risk Tolerance

Establishing clear financial objectives requires methodical evaluation of both aspirations and constraints. Investors should begin by quantifying time horizons and desired outcomes—whether saving for retirement or funding education. Tools like risk assessment questionnaires help gauge comfort with market fluctuations, translating abstract preferences into measurable metrics.

Setting Up Personalized Investment Objectives

Tailored strategies emerge from aligning asset allocations with individual priorities. A young professional might prioritize growth-oriented funds, while someone nearing retirement could focus on capital preservation. Platforms like Betterment use interactive sliders to adjust portfolio aggressiveness, ensuring allocations match evolving needs.

Digital dashboards simplify tracking progress toward benchmarks like home ownership or passive income targets. “Regular reviews prevent drift between intentions and actual holdings,” advises a certified financial planner. Automated alerts notify users when rebalancing becomes necessary due to life changes or market shifts.

Systematic planning transforms vague ambitions into actionable roadmaps. Investors benefit from quarterly check-ins to assess performance against initial goals. This disciplined approach minimizes emotional decisions while maintaining alignment with long-term financial visions.

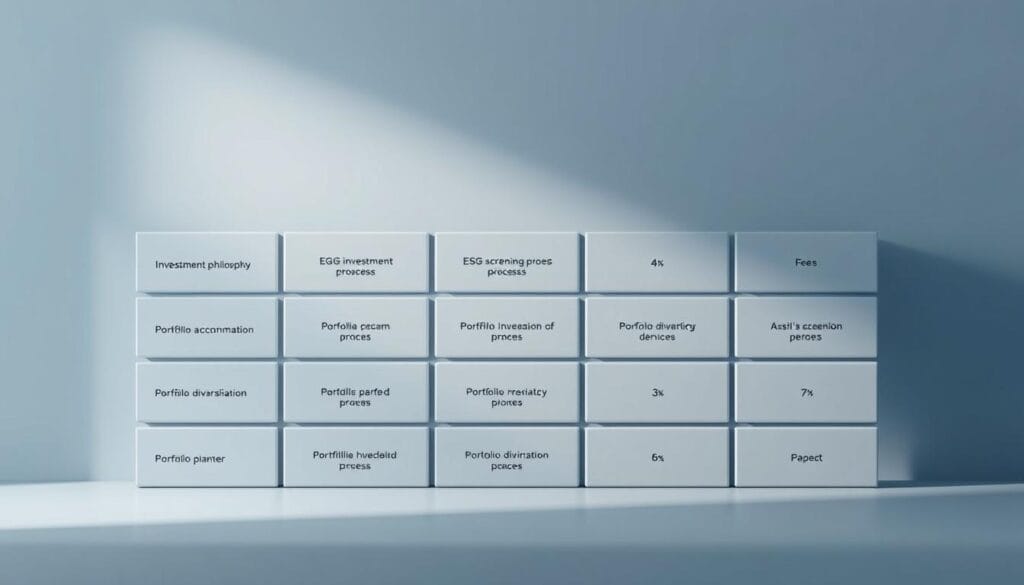

Choosing the Right ESG Robo-Advisor: Key Comparison Criteria

Strategic selection of automated wealth services demands analysis of three operational pillars: cost efficiency, asset diversity, and accessibility thresholds. Discerning investors evaluate how platforms balance these elements while maintaining ethical standards.

Operational Cost Analysis

Management fees range from 0.20% to 0.35% across leading platforms, with variations in ancillary charges. Wealthfront’s tax-optimization features justify its 0.25% fee, while Fidelity Go appeals to small-balance users with no minimum deposits. “Fee structures reveal much about a service’s priorities,” notes a Morningstar analyst.

Account minimums create accessibility tiers—Betterment welcomes micro-investors with $10 starters, whereas premium services require $100,000. Investors should match these thresholds with their capital deployment timelines.

Strategic Asset Allocation

Top automated wealth-building platforms offer 200-500 ESG-compliant stocks and funds. Diversification depth separates basic services from advanced counterparts. Fidelity Go blends thematic ETFs with traditional indexes, while Wealthfront enables direct exclusion of specific industries.

Hybrid models like SoFi combine algorithmic precision with human advisors, charging no extra fees for accounts above $50,000. This blend suits investors needing occasional guidance without compromising automation benefits.

Performance tracking tools prove critical—look for dashboards displaying real-time carbon impact per dollar invested. Prioritize services offering quarterly sustainability audits alongside financial reports to maintain dual-objective alignment.

Emerging Trends and Future of ESG Robo-Advisors

The next phase of algorithmic wealth management integrates cutting-edge technologies with stricter compliance standards. Artificial intelligence now processes satellite data to assess corporate environmental impacts, while blockchain tracks supply chain ethics in real time. These innovations enable platforms to refine sustainability metrics beyond traditional self-reported data.

Innovative Technologies and Evolving Regulations

Machine learning models predict regulatory shifts, automatically adjusting portfolios before new climate disclosure laws take effect. ETFs specializing in carbon-neutral technologies gain prominence as governments mandate cleaner business practices. The SEC’s proposed 2024 transparency rules already influence platform design, requiring clearer impact reporting for retail investors.

New compliance tools help navigate regional variations in sustainability standards. European Union’s SFDR framework drives demand for access to third-party verified funds. “Regulatory alignment will separate market leaders from followers,” predicts a Deloitte fintech analyst. Automated systems now incorporate jurisdictional filters to maintain global compliance.

Retirement-focused strategies benefit from these advancements. Dynamic algorithms balance long-term growth with reduced volatility through ETFs targeting age-specific sustainability goals. Younger savers see higher allocations to renewable infrastructure, while those nearing retirement prioritize stable social impact bonds.

Future platforms may integrate neural networks that simulate geopolitical impacts on green assets. This predictive capability could transform how individuals build wealth while addressing systemic challenges—proving technology’s role in harmonizing profit and planetary stewardship.

User Experience and Educational Resources in ESG Platforms

Modern investment platforms prioritize intuitive design to simplify complex financial decisions. Seamless mobile interfaces now allow investors to monitor portfolios, adjust strategies, and access support with minimal effort. These tools transform abstract concepts into actionable insights through visual dashboards and interactive features.

Mobile App Functionality and Customer Support

Leading services like Betterment and Wealthfront offer apps with one-tap rebalancing and real-time performance tracking. Push notifications alert users to market shifts requiring adjustments, saving critical time during volatility. “The best interfaces feel like financial co-pilots,” remarks a UX designer at Fidelity. Live chat support resolves queries within minutes, while video tutorials explain advanced features like tax optimization.

Accessibility extends to customer service channels. Platforms now integrate AI-driven chatbots for 24/7 assistance, complemented by human advisors for complex scenarios. This layered approach ensures users receive timely guidance without overwhelming them with technical jargon.

Learning Tools and Investment Calculators

Interactive calculators demystify long-term growth projections. Investors input variables like risk tolerance and time horizons to visualize potential outcomes. For example, automated portfolio management tools demonstrate how monthly contributions compound under different market conditions.

Educational modules break down sustainability metrics, showing how rebalancing affects both returns and carbon footprints. Real-time performance dashboards highlight progress toward personal goals while quantifying social impact. These resources empower users to make informed decisions aligned with their values and financial objectives.

Conclusion

The integration of ethical criteria into digital wealth management marks a pivotal shift in modern finance. Automated systems now empower investors to achieve dual objectives: competitive returns and measurable societal progress. Platforms like Wealthfront and Betterment demonstrate how algorithmic precision can align portfolios with personal values while maintaining cost efficiency.

Detailed comparisons reveal distinct advantages across services—from Fidelity Go’s budget-friendly approach to SoFi’s hybrid advisory model. These tools simplify complex decisions through dynamic rebalancing and real-time impact tracking. Investors gain access to institutional-grade strategies once reserved for high-net-worth individuals.

As the sector evolves, emerging technologies promise deeper customization and regulatory compliance. Forward-looking platforms will likely incorporate predictive analytics to anticipate market shifts and sustainability trends. This progression ensures index-based solutions remain adaptable to both financial goals and global challenges.

For those exploring ethical allocation, the current range of automated options offers unprecedented flexibility. By leveraging these innovations, individuals can transform capital into a force for progress—proving profitability and responsibility thrive best when strategically aligned.