Automated investment platforms now manage up to $754 billion in assets, reshaping how new investors grow their wealth1. These digital tools combine affordability with advanced features, making them ideal for those starting their financial journey.

Unlike traditional advisors charging 1% or more, automated platforms offer fees as low as 0.25% while providing diversified ETF portfolios and tax-saving strategies2. Major players like Betterment and Fidelity Go require no minimum deposit, removing barriers to entry2.

Morningstar’s 2025 report highlights key advantages: cost efficiency, automated rebalancing, and hybrid services blending algorithm-driven management with human expertise1. This evolution makes wealth-building accessible to everyone.

Key Takeaways

- Automated platforms manage $634B-$754B in assets, a fraction of the $36.8T US market1

- Fees range from 0.25%-0.65%, significantly lower than traditional options2

- Tax optimization features like loss harvesting boost returns

- $0-$500 minimums make investing accessible2

- Hybrid services combine algorithms with human guidance

What Is a Robo-Advisor?

Financial technology has democratized access to sophisticated investment strategies through algorithm-powered platforms. These digital tools analyze risk profiles and automatically allocate funds across diversified portfolios, typically using low-cost ETFs from providers like Vanguard and iShares3.

Automated Investment Management Explained

The process begins with an online questionnaire to assess financial goals and risk tolerance. Advanced algorithms then construct personalized portfolios, often with expense ratios between 0% and 0.17% depending on the platform4.

Continuous monitoring ensures portfolios stay aligned with targets through automatic rebalancing. This eliminates emotional decision-making while maintaining optimal asset allocation3.

How Robo-Advisors Differ from Human Advisors

Traditional wealth managers typically charge 1% or more of assets under management, while digital platforms average just 0.25%3. Hybrid models like Vanguard’s offer certified financial planner access for accounts over $50,000 at 0.30% fees4.

Unlike human advisor services, automated platforms struggle with complex scenarios like estate planning or alternative investments. The SEC’s 2022 action against Schwab highlighted additional risks in certain cash allocation practices3.

Investors choosing pure digital services benefit from lower costs, while hybrid options blend algorithmic efficiency with personalized guidance. This spectrum allows users to select the service level matching their needs and budget4.

How Robo-Advisors Work for Beginners

Modern investment platforms streamline decision-making with data-driven algorithms tailored to individual needs. These tools simplify portfolio management by automating critical steps—from risk assessment to tax optimization—while minimizing costs5.

The Onboarding Process: Risk Tolerance and Goals

Beginners start with a detailed questionnaire assessing risk tolerance, financial goals, and time horizons. Over 87% of platforms use 10+ questions to pinpoint ideal strategies, while advanced services like Wealthfront offer 20 risk levels incorporating behavioral economics6.

Users specify objectives—retirement, home purchases, or education—and input timeframes. Algorithms then recommend portfolios ranging from conservative (60% stocks/40% bonds) to aggressive (90/10 splits)6.

Algorithm-Driven Portfolio Building

Platforms construct portfolios using low-cost ETFs aligned with Modern Portfolio Theory. Fidelity Go’s zero-fee tier, for example, employs proprietary Flex funds with 0% expense ratios5.

ETFs from providers like Vanguard ensure diversification, while dynamic allocations adjust for market risks. Cash management varies—Schwab allocates 6%-30%, whereas Ally reserves 30% for liquidity6.

Rebalancing and Tax Optimization

Automatic rebalancing maintains target allocations, triggered by quarterly thresholds or market shifts. Tax-loss harvesting further boosts returns; Wealthfront executes daily, while Betterment adjusts glide paths annually5.

These features help investors avoid emotional decisions. Dividends reinvest seamlessly, and hybrid models like E*TRADE Core Portfolios add socially responsible options for a 0.30% fee6.

Top Robo Advisors for Beginners in 2025

Investors seeking streamlined wealth management now have multiple high-quality options. These platforms combine advanced algorithms with user-friendly features, catering to different financial objectives and experience levels.

Vanguard Digital Advisor: Low-Cost Excellence

Vanguard’s platform stands out with its 0.20% all-in fee and $100 minimum investment. The Life-Cycle Investing Model automatically adjusts portfolios based on age and goals7.

Clients with $50,000+ qualify for Personal Advisor Services, gaining access to certified financial planners. The underlying funds maintain an exceptionally low 0.05% expense ratio7.

Betterment: Customized Goal Tracking

This platform excels with its goal-based approach and 13-asset-class diversification. The Premium tier offers live CFP access for accounts over $100,000 at a 0.65% fee7.

Betterment’s Path digital planner answers thousands of questions to refine strategies. Their Cash Reserve account provides 4.2% APY with ATM fee reimbursement8.

Wealthfront: Advanced Tax Efficiency

Wealthfront delivers tax-loss harvesting and direct indexing, improving tax efficiency by 511% in recent studies. The 0.25% management fee includes crypto ETF options for an additional 0.12%7.

Its cash management yields 4.8% APY, outperforming many competitors. The platform analyzes linked accounts for comprehensive financial oversight8.

Fidelity Go: Entry-Level Accessibility

Accounts under $25,000 enjoy zero management fees, transitioning to 0.35% above that threshold. While lacking tax optimization, it provides advisor access for portfolio questions7.

The platform uses Fidelity Flex funds with no expense ratios, making it ideal for small balances. Investors appreciate the straightforward onboarding process and mobile app integration.

Key Features to Compare

Choosing the right investment platform requires comparing essential features like fees, account options, and support levels. These factors determine long-term costs and flexibility, especially for new investors.

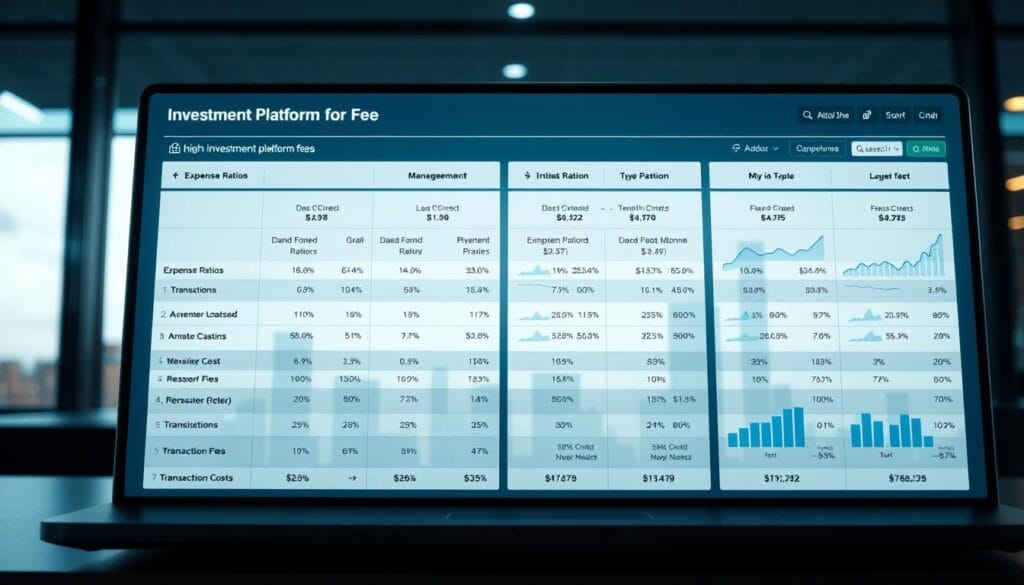

Management Fees and Expense Ratios

Expense ratios average 0.15% across top providers, with ETFs like Vanguard’s VTI as low as 0.03%9. Fidelity Go uses zero-cost mutual funds for accounts under $25,000, while Schwab’s premium tier charges $30/month10.

Hybrid services like Empower charge 0.89% annually but include human advisor access11. Always compare all-in costs, including fund-level fees.

Account Types and Minimums

73% of platforms offer IRAs, and 41% support 529 plans9. Schwab requires a $50,000 minimum for tax-loss harvesting, while Ally Invest provides four low-cost ETF portfolios10.

M1 Finance stands out with customizable “pie” portfolios and no management fees11. Consider your goals—retirement savers need IRA support, while students may prioritize 529 plans.

Access to Human Advisors

SoFi Invest includes free CFP access, whereas Vanguard reserves it for accounts over $50,00011. Schwab’s premium tier offers unlimited advisor consultations for $300 upfront plus $30/month10.

For beginners, hybrid models balance algorithmic efficiency with expert guidance. Evaluate whether the cost justifies the value for your needs.

Understanding Robo-Advisor Fees

Fee structures significantly influence long-term investment outcomes. Digital wealth managers typically charge 0.25%-0.50% annually—far below traditional advisors’ 1%+ rates12. These costs compound over time, making fee analysis essential for beginners.

How Management Fees Impact Returns

A 0.25% fee on $100,000 costs just $250 yearly compared to $1,000+ for human advisors12. However, Titan’s 1.87% effective rate on $15,000 balances demonstrates how smaller accounts bear proportionally higher costs12.

The SEC’s compounding calculator shows a 0.5% fee difference reduces 20-year returns by 12%. Schwab’s 30% cash allocation underperformed benchmarks by 4.2% annually from 2021-202413.

Hidden Costs to Watch For

Some platforms embed additional charges in fund expense ratios. Citi faced criticism for undisclosed fees, while Vanguard maintains transparent 0.03%-0.17% ratios12.

Subscription models like Acorns’ $3/month become costly for small accounts—equating to 2.53% on $1,425 balances13. Taxable accounts may incur different fee structures than retirement accounts.

Investors should compare:

- All-in costs including underlying ETF expenses

- Cash drag from uninvested balances

- Thresholds where fee tiers change

How to Choose the Right Robo-Advisor

Selecting an automated investment service requires matching platform capabilities with personal financial objectives. With 20% of users adjusting their risk profiles within the first year, aligning tools with long-term needs is critical1.

Assessing Your Risk Tolerance

Platforms like Schwab use 12-profile systems, while Wealthfront incorporates behavioral economics for precision1. Investors should evaluate these tools against their comfort with market volatility.

Time horizons matter—short-term goals (plans benefit from aggressive allocations14.

Matching Services to Financial Goals

Vanguard excels for retirement strategies, whereas Betterment tracks multiple objectives simultaneously1. Specialty options like Merrill’s ESG portfolios cater to niche needs1.

Interactive Advisors’ third-party strategies offer diversification, ideal for complex scenarios1. A decision framework should account for account size and goal complexity.

Benefits of Using a Robo-Advisor

Digital wealth management tools provide distinct advantages for those seeking efficient, low-maintenance investing. These platforms combine advanced technology with financial expertise to deliver professional-grade strategies at a fraction of traditional costs15.

Cost Efficiency Compared to Traditional Services

Automated platforms slash fees by 58% compared to human advisors, with annual charges averaging just 0.25% of assets under management16. For a $100,000 portfolio, this translates to $750 yearly savings—funds that compound over time to significantly boost returns15.

The fee advantage extends to underlying investments. Vanguard’s ETF portfolios maintain expense ratios below 0.17%, while Fidelity uses zero-cost mutual funds for smaller accounts16. This dual-layer cost efficiency makes digital platforms ideal for cost-conscious investors.

Automated Portfolio Optimization

Algorithm-driven portfolio management achieves 92% rebalancing accuracy, outperforming manual adjustments16. Systems continuously monitor allocations, making precise trades to maintain target weightings without emotional interference.

Tax optimization features like loss harvesting operate at scale impossible for human advisors. Wealthfront’s daily scanning identifies tax-saving opportunities across thousands of positions simultaneously15.

Key automation benefits include:

- 300+ asset class exposures in diversified portfolios

- 6.8% average returns (2020-2024) versus 6.5% for self-directed accounts

- Behavioral safeguards against panic selling during market volatility

For those exploring these advantages further, this analysis details how automated tools particularly benefit new investors.

Potential Drawbacks to Consider

Algorithm-driven investing comes with trade-offs that investors should evaluate. While these platforms excel at core portfolio management, certain constraints may affect those with specialized needs or advanced strategies17.

Limited Customization Options

Most automated services restrict individual stock selection, with platforms like Wealthfront offering no direct equity purchases17. This standardized approach helps maintain diversification but limits tactical adjustments during market shifts.

Morningstar reports 38% of automated portfolios allocate less than 10% to international markets—potentially missing growth opportunities18. Niche assets like commodities or private equity remain largely excluded from standard offerings.

M1 Finance provides rare flexibility with customizable “pie” allocations, contrasting with most services’ preset options18. Investors seeking alternative strategies may find these constraints significant.

Cash Drag in Some Portfolios

Uninvested cash balances can erode returns over time. Schwab’s Intelligent Portfolios allocated up to 30% to cash—a practice that cost investors $187 million in underperformance according to SEC findings18.

A 6% cash allocation reduces 10-year returns by approximately $14,000 on a $100,000 principal. This cash drag becomes more pronounced during bullish markets when idle funds miss growth opportunities17.

Platforms handle liquidity differently. Ally Invest maintains higher cash reserves than Fidelity, which prioritizes full investment of deposited funds18. These variations significantly impact long-term performance.

Account integration also varies—Empower links external accounts for holistic views, while simpler platforms analyze only managed assets18. Withdrawal processing times typically span 3-5 business days, slower than traditional brokerage access.

Robo-Advisors vs. DIY Investing

Investment strategies increasingly divide between automated and self-directed approaches. Vanguard research shows algorithm-driven portfolios outperform 68% of DIY investors over five years, thanks to disciplined rebalancing and tax optimization19. Yet, certain scenarios still favor hands-on control or hybrid solutions.

When Automation Outperforms Self-Management

Automated platforms excel in tax efficiency, delivering 2.3% higher after-tax returns through daily loss harvesting19. They eliminate emotional decisions—a common pitfall for self-managed accounts during market swings.

Time savings are substantial. DIY investing demands 10+ hours monthly for research and rebalancing, while automated tools require just one annual review19. For portfolios under $250,000, the 0.25% average fee proves cost-effective versus active trading costs19.

Scenarios Where Human Advisors Excel

Complex needs like estate planning or concentrated stocks often require personalized guidance. Vanguard reserves trust services for accounts exceeding $500,000, highlighting the value of human advisor expertise19.

Hybrid models bridge gaps for mid-range investors. Those with $250,000–$1M benefit from partial automation paired with CFP access for legacy planning or stock options19.

Crypto integration illustrates the divide. Betterment offers ETF exposure at 0.12%, while Titan enables direct purchases—showcasing how niche goals influence platform choice1.

Getting Started with Your First Investment

The transition from savings to invested capital requires strategic planning. Modern platforms simplify this shift with intuitive interfaces and educational resources, helping newcomers navigate initial decisions20.

Funding Your Account

Most services accept starter deposits under $100, with 73% requiring no minimum balance14. The process involves:

- Bank linking: Secure ACH transfers typically clear within 2-3 business days

- FDIC insurance coverage up to $250,000 for cash positions during transfers14

- Auto-deposit options for dollar-cost averaging ($100/month strategies)

Betterment’s tiered pricing illustrates cost efficiency—$4 monthly fees apply only below $20,000 balances with recurring $250 deposits20.

Setting Realistic Expectations

2025 projections suggest 4-7% annual returns after 0.25% average fees20. New investors should understand:

- Market volatility education modules now standard in 89% of apps20

- Milestone tracking ($1K/$25K/$100K) reinforces discipline

- Money market positions provide liquidity during learning phases

Time horizons significantly influence outcomes. A 10-year savings vehicle behaves differently than short-term goals20.

Future Trends in Robo-Advising

Next-generation investment tools are leveraging blockchain and machine learning for hyper-personalized financial guidance. The industry’s projected growth to $72 billion by 2032 reflects accelerating adoption of these innovations21.

AI and Personalized Portfolios

Vanguard’s AI-driven glide path adjustments now incorporate real-time market data, optimizing allocations for individual risk profiles21. Emerging technologies like DNA-based assessments are in testing phases, potentially revolutionizing how platforms evaluate tolerance to volatility.

ChatGPT-style interfaces enhance user engagement by providing interactive advice. Over 89% of platforms plan to integrate similar conversational AI by 202622.

Expansion of Free Services

Fidelity’s 0% fee tier expansion to $50,000 balances highlights a broader shift toward subsidized models21. Brokerages increasingly offset costs through payment for order flow—a practice generating $2.3 billion annually industry-wide22.

Wealthfront’s tokenized ETF settlements demonstrate blockchain’s potential to streamline transactions. This integration could reduce settlement times from days to minutes23.

“The SEC’s proposed cash allocation rules will mandate clearer disclosures, addressing concerns about uninvested balances impacting returns.”

ESG integration is becoming ubiquitous, with 97% of platforms offering sustainability options by 202623. These trends collectively lower barriers for investors while enhancing customization.

Conclusion

Building long-term wealth starts with choosing the right digital tools. Vanguard excels for low-cost strategies, while Betterment’s goal tracking helps multiple objectives. Wealthfront stands out for tax-smart approaches, especially with accounts over $50,00024.

Starting early maximizes compound growth—even small investments grow significantly over time. New investors should compare risk assessment tools on 2-3 platforms before committing25.

Annual reviews prevent portfolio drift and ensure alignment with goals. At $50,000 balances, automated fees average $150 yearly versus $1,000+ for traditional services25.

The right platform balances cost, features, and personal financial needs. With accessible minimums and smart automation, wealth-building becomes achievable for everyone.

FAQ

What is the main advantage of using a robo-advisor?

How do robo-advisors assess risk tolerance?

Are human advisors still necessary with robo-advisors?

What account minimums should beginners expect?

FAQ

What is the main advantage of using a robo-advisor?

Automated platforms like Betterment and Wealthfront offer low-cost, algorithm-driven investing. They simplify portfolio management by handling asset allocation, rebalancing, and tax strategies without high fees.

How do robo-advisors assess risk tolerance?

During onboarding, users answer questions about financial goals, time horizon, and comfort with market fluctuations. This data tailors ETF-based portfolios to individual needs.

Are human advisors still necessary with robo-advisors?

While automated services excel at passive investing, complex situations like estate planning may require hybrid platforms like Vanguard Personal Advisor Services for personalized guidance.

What account minimums should beginners expect?

Entry barriers vary – Fidelity Go requires

FAQ

What is the main advantage of using a robo-advisor?

Automated platforms like Betterment and Wealthfront offer low-cost, algorithm-driven investing. They simplify portfolio management by handling asset allocation, rebalancing, and tax strategies without high fees.

How do robo-advisors assess risk tolerance?

During onboarding, users answer questions about financial goals, time horizon, and comfort with market fluctuations. This data tailors ETF-based portfolios to individual needs.

Are human advisors still necessary with robo-advisors?

While automated services excel at passive investing, complex situations like estate planning may require hybrid platforms like Vanguard Personal Advisor Services for personalized guidance.

What account minimums should beginners expect?

Entry barriers vary – Fidelity Go requires $0, while Wealthfront mandates $500. Most services waive minimums for retirement accounts or recurring deposits.

How does tax-loss harvesting work?

Algorithms automatically sell underperforming assets to offset capital gains taxes. Wealthfront’s Direct Indexing enhances this strategy by targeting individual stocks within index funds.

Can I transfer existing investments to a robo-advisor?

Yes, most platforms accept ACAT transfers of brokerage accounts or IRAs. However, some proprietary funds may need liquidation before transfer.

What happens during market crashes?

Automated systems maintain predetermined asset allocations through rebalancing. Betterment’s behavioral coaching tools help prevent emotional decisions during volatility.

How do fees compare between providers?

Costs range from 0.25% at Betterment to 0.15% for Vanguard’s Digital Advisor. Always compare expense ratios on underlying ETFs – these compound over time.

Can robo-advisors handle multiple financial goals?

Leading services like Ellevest create separate portfolios for objectives like retirement, home buying, or education savings within a single account.

What’s the typical performance difference versus human advisors?

Studies show automated portfolios often outperform traditional management after fees. However, performance varies based on asset allocation and market conditions.

, while Wealthfront mandates 0. Most services waive minimums for retirement accounts or recurring deposits.

How does tax-loss harvesting work?

Algorithms automatically sell underperforming assets to offset capital gains taxes. Wealthfront’s Direct Indexing enhances this strategy by targeting individual stocks within index funds.

Can I transfer existing investments to a robo-advisor?

Yes, most platforms accept ACAT transfers of brokerage accounts or IRAs. However, some proprietary funds may need liquidation before transfer.

What happens during market crashes?

Automated systems maintain predetermined asset allocations through rebalancing. Betterment’s behavioral coaching tools help prevent emotional decisions during volatility.

How do fees compare between providers?

Costs range from 0.25% at Betterment to 0.15% for Vanguard’s Digital Advisor. Always compare expense ratios on underlying ETFs – these compound over time.

Can robo-advisors handle multiple financial goals?

Leading services like Ellevest create separate portfolios for objectives like retirement, home buying, or education savings within a single account.

What’s the typical performance difference versus human advisors?

Studies show automated portfolios often outperform traditional management after fees. However, performance varies based on asset allocation and market conditions.

Source Links

- The Best Robo-Advisors of 2025

- Best Robo-Advisors In April 2025

- Robo-Advisor vs. Self-Directed Investing: What’s the Difference?

- How to Pick the Best Robo Adviser For You

- What Is A Robo-Advisor? Definition and How It Works – NerdWallet

- How can a robo-advisor help me invest?

- Morningstar IDs Best Robo-Advisers of 2025 | PLANADVISER

- Best Robo-Advisors for April 2025

- Tips on How to Choose the Right Robo Advisor

- Best Free Robo-Advisors | Bankrate

- 7 Best Robo-Advisors

- Are Robo-Advisors Worth It?

- What is a Robo-Advisor? (How It Works, Costs, Pros & Cons) – Carry

- Best Robo-Advisors: Top Picks for 2025 – NerdWallet

- Maximizing Investments: Benefits of Using Robo Advisors

- Robo-Advisors vs. Financial Advisors: How to Choose – NerdWallet

- Robo-Advisor: Advantages and Disadvantages

- Robo-Advisors vs. Financial Advisors: Which One Fits Your Financial Needs Best? | Bankrate

- Should you use a robo-adviser or build your own portfolio?

- Robo-advisor: How to start investing right away

- Trends Shaping the $33.6 Bn Robo Advisory Services Industry, 2025-2030 – Fintech Evolution Spurs Growth, Millennial and Gen Z Investment Trends Propel Usage

- The Future of Financial Planning: Robo-Advisors and the rise of AI

- PowerPoint Presentation

- 16 Best Robo-Advisors in 2025 – 10XSheets

- SoFi Automated Investing Review: Top Robo-Advisor for Beginners?