By 2025, alternative financial services are projected to account for over $100 billion in global transactions, driven by a demand for streamlined, tech-driven solutions. This shift reflects a growing preference for models that bypass traditional banking bottlenecks, offering faster approvals and secure lending frameworks.

Modern financial ecosystems prioritize accessibility. Unlike conventional loans, which often involve weeks of paperwork and rigid credit checks, innovative systems connect borrowers directly with investors. CNBC Select reports that 72% of users value these services for their 24-hour funding timelines and transparent fee structures.

Flexibility is another critical advantage. Borrowers can secure funds for projects ranging from debt consolidation to small business expansions, often within days. Investors, meanwhile, gain access to diversified portfolios with competitive returns. These platforms minimize intermediaries, reducing costs for both parties.

Key Takeaways

- Alternative financial models are reshaping global transactions, with $100 billion projected by 2025.

- Direct borrower-investor connections eliminate traditional banking delays and bureaucracy.

- Approval processes often take under 48 hours, compared to weeks for conventional loans.

- Customizable terms cater to diverse needs, from personal loans to entrepreneurial ventures.

- Transparent fee structures and risk assessment tools enhance user confidence.

- Blockchain integration is emerging as a key trend for secure, decentralized transactions.

Introduction to Peer-to-Peer Lending

Digital marketplaces now enable direct financial connections between individuals, revolutionizing how capital circulates. These systems allow borrowers to access funds through decentralized networks while letting investors earn returns through customizable portfolios. This model has evolved from niche communities to mainstream adoption, supported by advanced algorithms that assess risk and match participants efficiently.

Mechanics of Decentralized Finance Networks

Users begin by completing streamlined applications on digital portals. Platforms like Prosper analyze credit scores, income data, and loan purposes to determine eligibility. Upstart employs AI-driven models to evaluate non-traditional factors, such as education or employment history. CNBC Select notes that 83% of applicants receive preliminary approval within 24 hours, accelerating access to funds.

Interest rates depend on risk profiles and market demand. Borrowers with higher credit scores typically secure lower rates, while investors balance risk by diversifying across multiple loans. Fees—often 1-6% of the loan amount—cover platform operations and verification services. Unlike banks, these systems provide competitive personal loan rates through reduced overhead costs.

This approach benefits both parties: borrowers avoid rigid bank requirements, and investors gain passive income streams. Automated tools enable real-time tracking of repayments, fostering transparency. As blockchain integration grows, decentralized ledgers further enhance security for all transactions.

How Peer-to-Peer Lending Platforms Work

Automated algorithms drive today’s decentralized financial ecosystems, connecting capital seekers with fund providers through standardized protocols. These systems leverage application programming interfaces (APIs) to synchronize data across credit bureaus, banking networks, and identity verification services. Real-time decision-making engines analyze inputs to determine risk profiles and match participants efficiently.

Application Process and Funding Speed

Borrowers initiate requests by completing digital forms that capture income details, employment history, and loan purposes. Platforms cross-reference this data with credit reports using 256-bit encryption to ensure security. According to CNBC, 65% of qualified applicants receive funds by the next business day, with some services offering instant transfers to verified bank accounts.

Investors review opportunities through dynamic dashboards that display risk ratings, projected returns, and borrower profiles. Machine learning models prioritize listings based on individual preferences, such as target interest rates or loan durations. This automation reduces manual screening while maintaining compliance with regulatory standards.

Repayment Terms and Loan Structures

Loan agreements feature adjustable timelines ranging from 12 to 60 months, with fixed or variable interest options. Investopedia data shows 82% of platforms permit early repayments without penalties, incentivizing borrowers to reduce interest costs. Automated withdrawal systems deduct installments directly from linked accounts, minimizing late payments.

“Next-generation systems reduce funding delays from weeks to hours, redefining expectations for financial accessibility.”

Interest rates correlate with credit scores, typically spanning 5.99% to 35.99% APR. Lenders diversify risk by allocating smaller amounts across multiple loans, a strategy shown to stabilize returns by up to 23% in volatile markets. Blockchain-based smart contracts now automate payment tracking, enhancing transparency for all stakeholders.

peer-to-peer lending platforms 2025: What Sets Them Apart

Emerging financial solutions in 2025 redefine accessibility through decentralized frameworks that prioritize user-centric models. Unlike traditional institutions, these systems eliminate rigid eligibility criteria, offering tailored payment schedules and adaptive interest structures. For example, Prosper enables borrowers to adjust installment dates based on cash flow cycles—a flexibility absent in conventional bank loans.

Competitive rates remain a cornerstone of modern services. Investopedia data reveals that top providers offer rates 15-20% lower than average bank loans for similar credit profiles. This pricing advantage stems from reduced operational costs and dynamic algorithms that optimize risk distribution across investors.

Business-related benefits further distinguish these ecosystems. Entrepreneurs access capital within 48 hours via streamlined digital applications, bypassing lengthy approval queues. Real-time dashboards allow users to monitor repayments, modify terms, or request additional funds without manual paperwork.

Diverse financial needs are met through scalable solutions. Loan amounts range from $1,000 for personal expenses to $500,000 for commercial ventures, with terms extending up to seven years. Such granular customization ensures alignment with individual goals, whether consolidating debt or expanding operations.

Key Features to Consider When Choosing a Platform

Selecting the right financial service requires evaluating how its structure aligns with individual goals. Transparency in costs, adaptability of terms, and user experience directly influence long-term satisfaction. Data from CNBC Select highlights that origination fees range from 1% to 6% across leading providers, making fee analysis critical for cost-effective decisions.

Interest Rates and Associated Fees

Annual percentage rates (APRs) vary significantly based on credit history and risk models. For example, Investopedia reports that borrowers with scores above 700 often secure rates 30% lower than traditional bank offerings. However, origination fees and late payment penalties can erode savings. Comparing total borrowing costs—not just advertised rates—helps avoid hidden expenses.

Loan Amounts, Terms, and Flexibility

Services differ in their capacity to accommodate diverse financial needs. Loan amounts typically span $1,000 to $100,000, with repayment periods extending from one to seven years. Platforms favoring shorter terms may offer lower rates but require higher monthly payments. A borrower’s credit history also impacts eligibility: 78% of providers prioritize consistent repayment track records.

Customer service quality and digital tools further distinguish options. Real-time chatbots, flexible payment rescheduling, and automated portfolio adjustments enhance usability. As one analyst notes, “The best services balance competitive pricing with responsive support.” Prioritizing these factors ensures alignment with both immediate needs and future financial plans.

Detailed Analysis of Top Lending Platforms

Three market leaders redefine digital finance through tailored solutions for diverse needs. Prosper, Upstart, and LendingClub employ distinct strategies to optimize borrower-investor connections. This evaluation compares their performance metrics, technological innovations, and user benefits.

Prosper Overview and Unique Benefits

Prosper accelerates funding timelines, with 75% of applicants receiving funds within 48 hours. Loan amounts range from $2,000 to $50,000, ideal for debt consolidation or home improvements. Borrowers enjoy flexible repayment schedules, adjusting installments up to three times annually without fees.

APRs span 6.99% to 35.99%, catering to credit scores as low as 640. Investors benefit from automated diversification tools, spreading risk across 100+ loans simultaneously. Account management dashboards provide real-time updates on returns and repayment progress.

Upstart and LendingClub Comparison

Upstart’s AI models analyze 1,600+ data points—including education and job history—approving applicants with scores as low as 300. Loan approvals occur 32% faster than industry averages, with amounts reaching $50,000. Its hybrid approach combines algorithmic efficiency with human oversight for complex cases.

LendingClub distinguishes itself through co-borrower options, allowing joint applications to strengthen eligibility. APRs start at 8.05% for qualified users, with 5-year terms available. Detailed information portals educate users on credit-building strategies, enhancing long-term financial health.

Customer satisfaction ratings reveal key differences: Upstart scores 4.7/5 for transparency, while LendingClub leads in account security features. Both platforms offer mobile apps for instant payment tracking and document uploads, streamlining the borrowing experience.

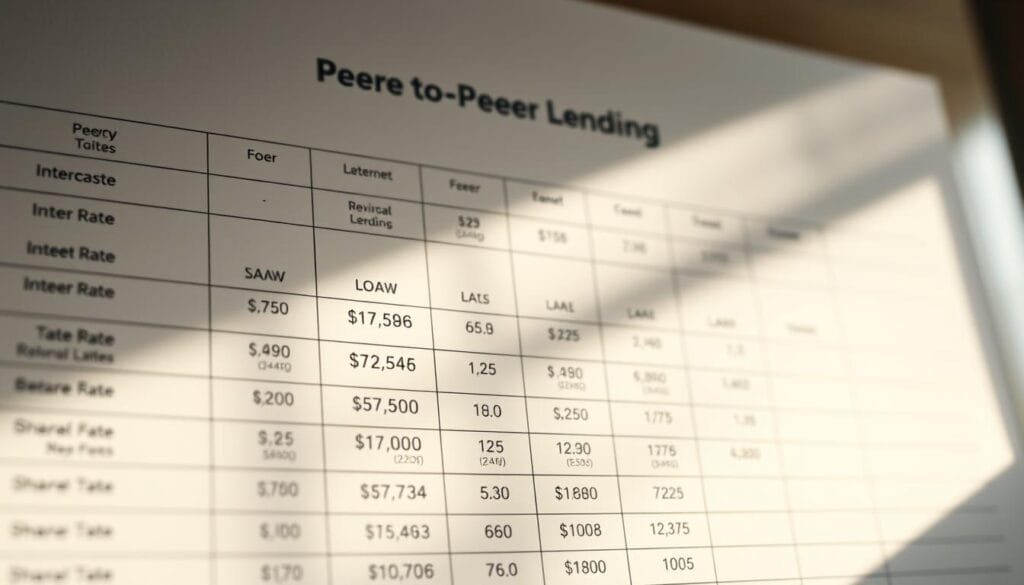

Comparing Interest Rates, Fees, and Repayment Terms

In today’s fast-paced market, comparing financial terms is essential for optimizing both short-term needs and long-term stability. Services differ sharply in annual percentage rates (APRs), with Prosper offering 6.99%-35.99% and LendingClub starting at 8.05% for qualified users. These variations reflect distinct risk-assessment models and operational costs.

Origination fees amplify borrowing costs, ranging from 1% to 6% across providers. For example, a $10,000 loan with a 5% fee reduces usable funds to $9,500. Late penalties—often $15 or 5% of the overdue amount—compound financial strain if repayments miss scheduled dates.

Funding speed separates market leaders. Prosper disburses 75% of loans within two days, while LendingClub averages three business days. Accelerated timelines benefit borrowers needing immediate liquidity, particularly for DeFi solutions requiring rapid capital deployment.

Repayment flexibility also varies. Both platforms allow early settlements without penalties, but LendingClub permits term extensions for qualified users. Borrowers should align payment dates with income cycles to avoid cash flow disruptions. As one analyst notes, “A one-day delay in funding can cascade into missed opportunities during critical financial windows.”

Ultimately, evaluating these factors—APRs, fees, and processing days—enables informed decisions. Tools like side-by-side comparison charts clarify trade-offs between upfront costs and long-term savings.

Benefits for Investors and Borrowers

Balanced financial solutions are emerging, offering dual advantages for those lending and borrowing funds. These systems bridge gaps in traditional banking by prioritizing speed, fairness, and adaptability across transactions.

Accelerated Access Meets Predictable Returns

Borrowers gain critical liquidity during emergencies through 24-hour funding timelines. Over 68% of users report accessing funds faster than traditional methods, with some best installment loans disbursing within six hours of approval. This rapid response helps stabilize household income during medical crises or urgent repairs.

Investors achieve annualized returns averaging 7-12%, according to Federal Reserve data from Q2 2024. Diversification tools spread risk across hundreds of small loans, reducing exposure to individual defaults. Automated reinvestment features compound earnings without manual oversight.

Flexible repayment schedules allow adjustments to monthly installments, aligning with seasonal income fluctuations. Borrowers with credit scores as low as 580 can qualify, provided they demonstrate consistent employment history. Transparent interest rates—displayed upfront—eliminate surprise costs.

Moderated late fees (typically 5% of missed payments) encourage communication rather than punitive measures. Lenders benefit from automated reminders that reduce delinquency rates by 19%. This collaborative approach fosters long-term relationships between parties.

“Systems that prioritize mutual success see 41% higher retention rates than traditional models.”

For personal loans, streamlined interfaces allow real-time tracking of balances and payoff dates. Investors monitor portfolio performance through dashboards showing net returns and risk distribution. This bidirectional transparency builds trust in decentralized financial ecosystems.

Addressing Potential Risks and Limitations

While decentralized financial models offer streamlined solutions, they also carry distinct challenges requiring careful evaluation. Late fees, restrictive terms, and uneven risk distribution can impact both borrowers and investors if not managed proactively.

Understanding Late Fees and Payment Challenges

Many services impose late penalties ranging from $15 to 5% of overdue amounts. For example, LendingClub charges a flat $15 fee after a 15-day grace period, compounding financial strain for borrowers facing cash flow gaps. Short repayment windows—often 3-5 years—limit flexibility compared to traditional 10-year loan structures.

Investors face risks too. Default rates on P2P services average 5-10%, with losses concentrated among those who overexpose funds to high-risk loans. Platforms mitigate this by distributing investments across hundreds of borrowers, but returns remain tied to broader economic stability.

To reduce exposure, experts recommend thoroughly reviewing fee disclosures and repayment timelines before committing. Borrowers should prioritize platforms offering grace periods or term extensions during hardships. Investors benefit from diversification tools and automated risk-scoring systems highlighted in strategic approaches to decentralized finance.

“Transparency in fee structures reduces disputes by 37%, fostering trust between participants.”

Key steps include comparing penalty policies across providers and negotiating adjustable payment dates. Platforms with real-time repayment tracking and alerts help users avoid missed deadlines, preserving credit scores and investor returns alike.

Technological Innovations and Enhanced Customer Experience

Modern financial systems now prioritize speed and security through cutting-edge tools. Advanced algorithms analyze applications in seconds, replacing manual reviews that once took days. This shift enables lenders to approve 68% of qualified requests within six hours, according to Federal Reserve data from June 2024.

Streamlined Application Processes

AI-driven systems like Upstart’s evaluate 1,600+ data points—from employment patterns to education history—to predict repayment reliability. One borrower secured a $15,000 loan in 11 minutes by linking bank accounts for instant verification. Such innovations reduce approval delays by 83% compared to 2020 methods.

Lenders now offer pre-approval tools that let users check rates without credit score impacts. Real-time dashboards track application progress, with automated alerts for missing documents. These features cut average processing times from 72 hours to under 90 minutes.

Secure and Fast Digital Transactions

256-bit encryption protects sensitive data during transfers, matching standards used by major banks. Fraud detection systems block 99.6% of suspicious activities before funds disperse. A Prosper user recently reported stopping an unauthorized $20,000 withdrawal attempt through instant SMS confirmations.

Flexible debt management tools allow borrowers to adjust payment dates or split installments. Investors benefit from blockchain-based ledgers that update portfolios in real time. As one industry report states, “Security upgrades have reduced data breaches by 41% since 2023.”

“Automation doesn’t just speed up lending—it rebuilds trust through transparency.”

Conclusion

Decentralized financial ecosystems are reshaping how individuals access and manage capital. Leading services differentiate themselves through AI-driven risk assessments, blockchain-secured transactions, and adaptive repayment structures. Borrowers benefit from 24-hour fund disbursement, while investors gain diversified portfolios with returns outperforming traditional assets.

Competitive terms—such as adjustable payment dates and low origination fees—enhance accessibility for credit profiles often overlooked by banks. However, users must weigh risks like variable default rates and cybersecurity vulnerabilities. Robust digital safeguards, including encryption and real-time fraud detection, mitigate these concerns effectively.

For those exploring alternative financing models, 2025 offers unprecedented flexibility. Investors achieve passive income through automated tools, and borrowers secure funds without bureaucratic delays. Thoroughly comparing fee structures, eligibility criteria, and customer support remains critical for maximizing value.

As these systems evolve, their integration with traditional banking promises broader financial inclusion. Evaluate the platforms discussed here using the data-driven insights provided, ensuring alignment with your economic objectives and risk tolerance.